Published in October 12, 2021

Credit Scores in Australia, How Do They Work?

Your credit score is an important number - but how do credit scores in Australia work? Read on to find out.

Your credit score can have far-reaching implications for numerous aspects of your life. It can be the difference between you being accepted or rejected for credit. That’s why it’s important to know how credit scores in Australia work. That’s why we’ve put together this handy overview of how credit scores work.

Who calculates your credit scores in Australia?

In Australia, you have three credit scores and credit reports. Why’s this? Because there are three credit bureaus, also known as Credit Reporting Agencies (CRAs) in Australia. The three credit bureaus in Australia are Equifax, Experian and illion. Your Equifax credit score will range between 0 – 1,200, whereas your Experian and illion will fall somewhere between 0 – 1,000.

A credit bureau is a company that collects information associated with the credit scores of individuals. This means if you have any type of credit (a loan, credit card, utilities, etc) then the company you have this credit with (bank, non-bank lender, utility company, etc) will report the information associated with the credit to the credit bureaus. This can be your repayment history, credit limit and more.

The CRAs then collect this information and use it to generate your credit reports and calculate your credit scores. They then make your reports and scores available to credit providers (following your consent) to help them make informed decisions. You have one credit score and one credit report with each of the three bureaus.

How do the CRAs calculate your credit score?

Equifax, Experian and illion each individually calculate your credit scores. They calculate your credit scores based on the information contained in your credit report. This includes:

- Your active credit accounts, as well as any accounts closed in the last two years;

- Your repayment history from the past two years;

- Credit enquiries – every time you apply for a loan or other form of credit, it will appear on your credit report and remain there for five years;

- If you have defaulted on a credit repayment, it will appear on your credit report;

- Negative entries such as bankruptcy, court judgements and serious credit infringements will appear on your credit report.

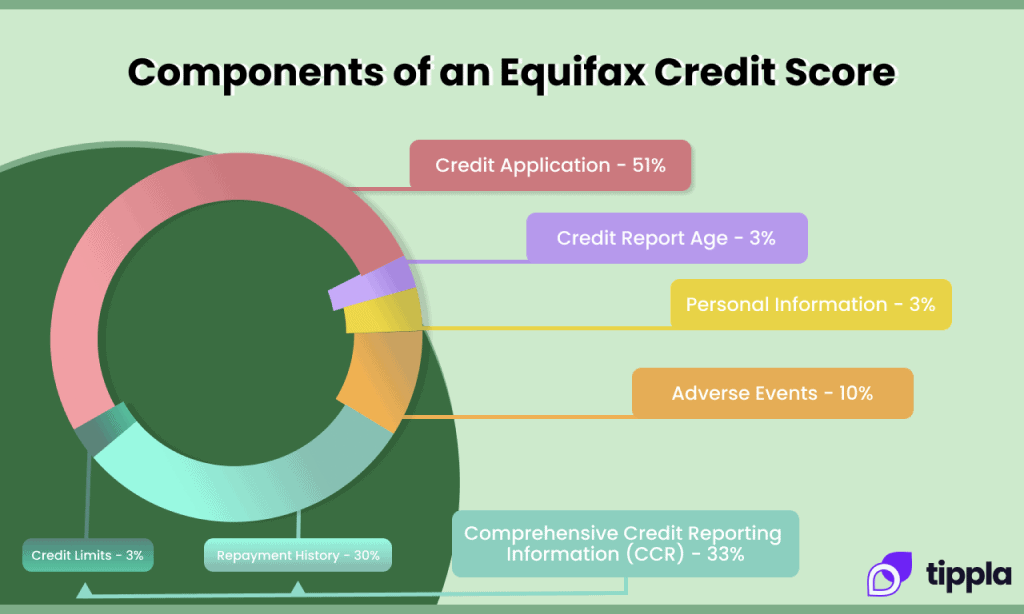

The exact formula each of the credit bureaus use to calculate your credit score remains a well-kept secret, however, Equifax has provided the below overview of how it typically calculates credit scores in Australia.

Source: Equifax

What harms your credit score?

Following the introduction of Comprehensive Credit Reporting (CCR), a combination of positive and negative information goes onto your credit report and is used to calculate your credit report.

Some good habits, such as consistently meeting your credit repayments, having a good mix of credit accounts (but not having too many), and not too many credit enquiries on your report can all contribute positively to your credit score.

However, there are also some things that can harm your credit score. We’ve listed some of the items that can harm your credit score below:

- Credit enquiries – when you apply for credit and the company you apply with checks your credit report, this is known as a hard enquiry. Hard enquiries harm your credit score, and the more applications you make in a short period of time, the worse the damage.

- Defaults – if you default on one of your credit repayments, then this will appear on your credit report and lower your credit score. Defaults will remain on your credit report for up to five years.

- Too many credit accounts – if you have too many credit accounts, such as multiple loans and credit cards, then this could indicate that you’re in financial stress. Therefore, when calculating your credit score, too many accounts can lower your score.

- Negative entries such as bankruptcy, court judgements and serious credit infringements can also harm your credit score as they suggest that you have not been able to handle your debt effectively in the past.

If your credit score isn’t where you want it to be, check out Tippla’s guide on how to improve your credit score.

What is a good credit score?

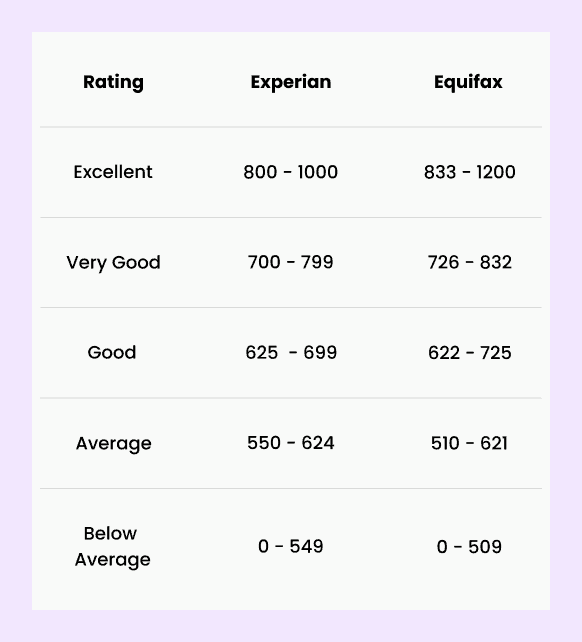

A good credit score in Australia varies among the bureaus. Specifically, your credit score will fall somewhere on a five-point scale. This scale ranges from below average, average, good, very good and excelled.

Here’s how Equifax and Experian rank your credit scores:

Source: Experian and Equifax

A good credit score for illion ranges from 500 – 699, whereas a great credit score falls between 700 – 799 and an excellent score sits from 800 – 1,000.

What are credit scores used for?

Your credit score is used to assess your creditworthiness (translation: how reliable of a borrower you are). Your credit score provides an overview of how well you have managed your credit debt in the past and therefore indicates how likely you will be to repay any further debt you take on.

What does this mean in basic terms? When you apply for a loan (such as personal loans or home loans), credit card, or any other form of credit, the company you are applying with want to know how likely you are to make your repayments.

A good credit score (or higher) indicates that you will likely make your repayments and you’re therefore a lower risk. An average or below-average credit score can imply that you might struggle to make your repayments, and could be at risk of defaulting.

With this in mind, your credit score is one of the factors credit providers use to assess how big of a risk you are and helps them determine whether they will accept your reject your credit application.

Who can view your credit score?

The purpose of your credit scores in Australia is to help credit providers determine how risky of a borrower you are. Therefore, the only companies that can view your credit score are the ones you have applied for credit with.When you apply for credit, typically in the terms and conditions, you will consent to having your credit score and report checked by the company. Some credit providers will only look at one credit score and report, however, others might look at two or all three. That’s why all of your credit scores matter, and no one score matters more than the others.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

Frugal Hacks for 2021 | Prepare For The End Of JobSeeker

30/07/2021

Make saving money fun with these frugal hacks for...

How to Prevent Mistakes on Your Credit Report

22/10/2021

Whilst mistakes on your credit report can be common,...

What Goes on My Credit Report & For How Long?

19/10/2021

Your credit report is an important document and it...

Cheques: What they are and how to use them

28/07/2021

Cheques are written documents that instruct financial institutions to...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog