Published in December 9, 2024

Credit Enquiries and Rental Applications

Credit Enquiries and Rental Applications in Australia: What Tenants Should Know

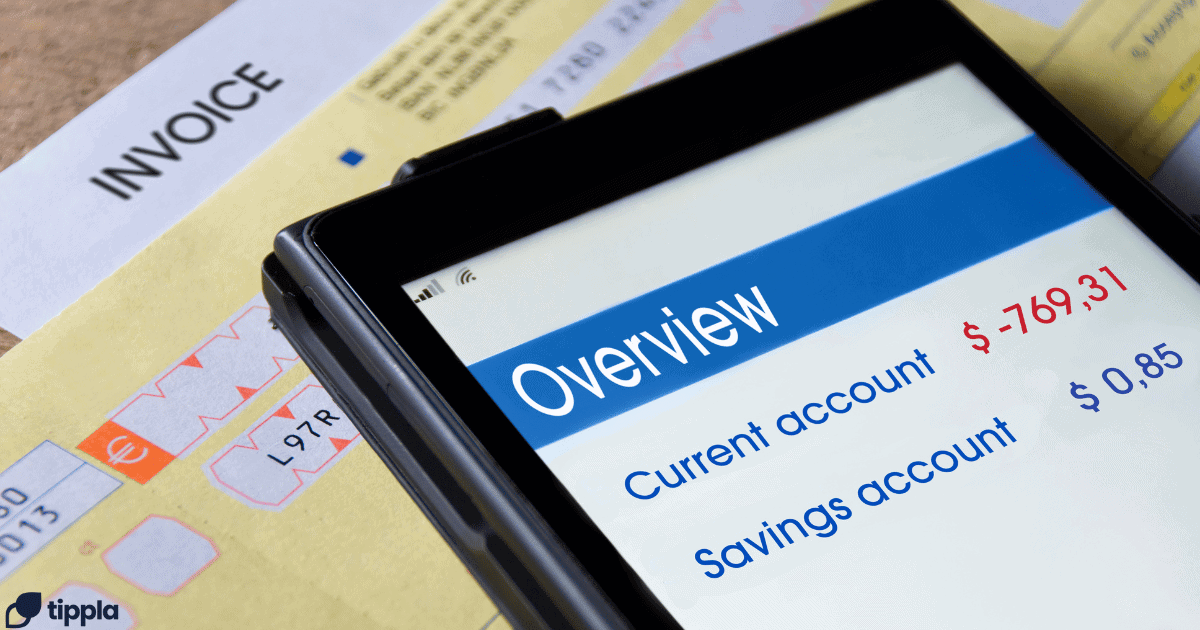

Navigating the rental market in Australia can be daunting, especially with the increasing scrutiny of credit checks and application requirements.

In a competitive housing landscape, landlords and real estate agents often rely on credit reports from agencies like Equifax to assess a tenant’s financial reliability. Understanding the specifics of what these checks entail and how they impact your rental application can make a significant difference in securing a property.

This article delves into the nuances of credit enquiries in Australia, offering practical advice on how to present a strong application and improve your chances of being accepted in a tight rental market.

Understanding Credit Enquiries

What are credit enquiries?

Credit enquiries, also known as credit checks, occur when a financial institution or another authorised entity accesses your credit report to assess your creditworthiness. In Australia, these enquiries are typically carried out by credit reporting agencies such as Equifax, Experian, or Illion. There are two types of credit enquiries: hard enquiries, which are conducted when you apply for credit or a loan, and soft enquiries, which are checks made for purposes like background checks or pre-approved credit offers.

How do credit enquiries affect my credit score?

Hard credit enquiries can impact your credit score. Each hard enquiry is recorded on your credit report and can stay there for up to five years. Multiple hard enquiries within a short period can signal to lenders that you may be taking on more debt than you can handle, which can lower your credit score. Soft enquiries, on the other hand, do not affect your credit score. It’s important to be mindful of the number and frequency of your credit applications to maintain a healthy credit score.

How can I manage my credit enquiries?

To manage your credit enquiries effectively, you should:

- Limit credit applications: Only apply for credit when necessary and avoid making multiple applications within a short time frame.

- Monitor your credit report: Regularly check your credit report to ensure all enquiries are accurate and dispute any errors promptly.

- Pre-qualify for credit: Use pre-qualification tools that perform soft enquiries to see if you are likely to be approved before making a formal application.

- Be strategic with timing: If you need to make multiple credit applications, try to space them out to minimise the impact on your credit score.

Rental Applications in Australia

In Australia, the rental application process typically begins with inspecting the property, either in person or through virtual tours. Once you’ve found a suitable property, you need to fill out a rental application form provided by the real estate agent or landlord. This form requires detailed personal information, including your employment history, income and contact details, and references. Submitting a complete and accurate application promptly is crucial due to the competitive nature of the rental market.

Required Documents and Information

To bolster your application, you’ll need to provide several key documents:

- Proof of Identity: Passport, driver’s licence, or other government-issued ID.

- Proof of Income: Recent payslips, employment contracts, or bank statements to demonstrate your ability to pay rent.

- Rental History: Previous rental agreements, rental references, personal references, and rent payment history.

- Supporting Documents: A cover letter explaining why you are a suitable tenant, pet references (if applicable), including steps you’ve taken to manage pet behavior and credit check results can also strengthen your application.

Common Reasons for Rental Application Rejection

Rental applications in Australia can be rejected for several reasons:

- Insufficient Income: Landlords need assurance that you can comfortably afford the rent. Providing clear evidence of stable and sufficient income is crucial.

- Poor Credit History: A history of late payments or significant debt can raise red flags for landlords.

- Incomplete Application: Missing information or documents can lead to immediate rejection, so ensure your application is thorough and complete.

- Negative Tenancy Database Listing: If you have been listed on a tenancy database for past rental issues, it can significantly impact your chances of approval.

- Failure to Inspect: Not inspecting the property can be a reason for rejection as it shows a lack of commitment or interest.

The Role of Credit History in Rental Applications

Why Landlords Check Credit History

Landlords routinely check prospective tenants’ credit histories to assess their financial reliability and consistently predict their ability to pay rent. A credit check reveals an applicant’s past behaviour in managing credit, highlighting any missed payments, defaults, or significant debts. This helps landlords mitigate risks associated with potential tenants who might default on rental payments. For instance, an applicant with a history of late payments or substantial outstanding debts may be seen as a higher risk, leading to rejection of their rental application.

Improving Your Credit History for Better Rental Prospects

To improve your chances of securing a rental property in Australia, consider the following strategies to enhance your credit history:

- Pay Bills on Time: Ensure all your bills, including utilities, credit cards, and loans, are paid on time to build a positive payment history.

- Reduce Outstanding Debt: Aim to lower your debt levels by paying down credit card balances and loans. This reduces your credit utilisation ratio and improves your credit score.

- Regularly Check Your Credit Report: Making use of free credit monitoring websites like Tippla can help you regularly check your credit report. It will also be easier to see errors that may be hurting your score.

- Avoid Multiple Credit Applications: Multiple credit inquiries in a short period can lower your credit score. Be selective and strategic about applying for new credit.

- Provide Strong References: Supplement your rental application with positive references from previous landlords to offset any minor credit issues.

Improving your credit history takes time and consistent effort, but it significantly enhances your rental prospects and financial stability.

Legal and Privacy Considerations

Tenant Rights

Australian tenants are protected by various laws that ensure their right to privacy and fair treatment. Landlords must adhere to the Privacy Act 1988 (Cth), which regulates the handling of personal information. They must obtain written consent before conducting a credit check, ensuring that tenants are aware and have agreed to this search. Additionally, landlords cannot misuse or disclose personal information obtained through credit checks without the tenant’s explicit permission.

Privacy Considerations

Tenants have the right to know what information is being collected and how it will be used. If a tenant’s application is rejected based on information found in a credit check, the landlord must inform the tenant and provide details about the adverse information. This transparency allows tenants to address any discrepancies or improve their credit history for future applications. Furthermore, landlords must store personal information securely and only use it for the purpose for which it was collected.

Credit history plays a crucial role in the Australian rental application process, as it allows landlords to assess a tenant’s financial responsibility and reliability. A strong credit score not only increases the likelihood of rental approval but also can impact the terms of the lease, such as the amount of the security deposit.

Tenants should be proactive in maintaining and improving their credit scores by managing their finances diligently and paying rent on time. Additionally, understanding their rights regarding privacy and consent for credit checks ensures they are treated fairly throughout the application process.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

5 Achievable Credit Score Goals for 2021

26/07/2021

We’re all about setting realistic credit score goals. We’ve...

Medical Loans: Options for Emergency Medical Expenses

15/03/2024

Unexpected medical emergencies can significantly impact individuals and families...

How to Prevent Mistakes on Your Credit Report

22/10/2021

Whilst mistakes on your credit report can be common,...

Understanding and Managing Overdraft Protection

21/05/2024

What is Overdraft Protection? In banking, an overdraft occurs...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog