Published in October 19, 2021

What Goes on My Credit Report & For How Long?

Want to know what goes on your credit report, and how long that information remains on your credit file? Then Tippla has the perfect guide for you.

Your credit report is an important document and it can have far-reaching implications. Any time you apply for a loan, credit card, mortgage, utilities, even a phone plan – your credit report plays an important role. That’s why we’re going to answer the question “what goes on my credit report”, as well as delve into how long information remains on your file.

What is a credit report?

A credit report is a document that outlines your recent credit history. Your credit history is an account of your credit activity. As outlined by Experian, credit is the ability to borrow money or utilise goods or services, with the understanding that you will repay the credit at a later date.

So your credit history is an account of any time you have used credit – whether it be a loan, credit card, utilities, phone plan and more. Your recent credit history appears on your credit report.

In Australia, you have three credit reports from the three credit bureaus in Australia – Equifax, Experian and illion. The information listed on your credit report is what’s used to calculate your credit score. Your credit score is a number ranging from 0 – 1,200 and provides an indication of your creditworthiness.

Why does my credit report matter?

Whenever you apply for credit (with limited exceptions), the company you are applying for credit with, will check your credit report. They do this to see how risky of a borrower you are.

Lenders will check the information on your credit report to look out for any red flags – do you have defaults on your report? Have you recently made a lot of credit applications recently which might indicate that you’re in financial difficulty? Or do you have a stellar credit report and a good credit score? These are some of the things credit providers will look out for when making their decision.

Whilst your credit report and credit score aren’t the only factors companies will consider when deciding whether to lend to you, it is an important piece of the application process. That’s why it’s a good idea to employ good credit behaviour to maximise the likelihood of being approved for a loan.

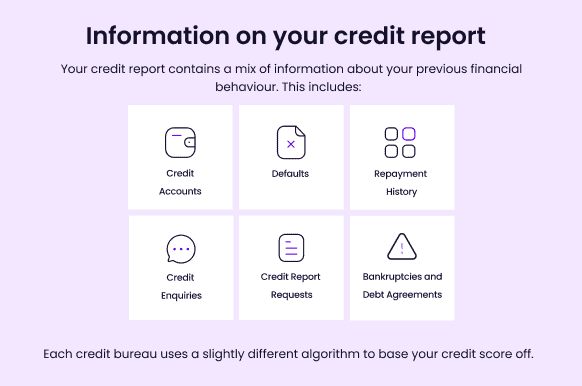

What goes on my credit report?

There is a lot of information that goes onto your credit report, but we’re here to break it down for you. Below is an outline of the information that can be stored on your credit report, if it’s applicable.

Credit enquiries

When you apply for a loan, credit card, or even utilities, this is known as a credit application or credit enquiry. As part of your application, typically in the terms and conditions, you are giving the company you’re applying with permission to check your credit score and credit report. When they check your credit report, this is referred to as a hard enquiry.

Each time you apply for some type of credit, and the resulting hard enquiry is made, it will appear on your credit report. This will occur regardless of whether you are accepted or rejected for the credit you apply for.

There are two types of enquiries – a hard enquiry or a soft enquiry. The main difference is that a hard enquiry is made after you have applied for money, whereas a soft enquiry is unrelated to lending you money.

Specifically, a hard enquiry is when a lender checks your credit report following a credit application. Hard enquiries harm your credit score and remain on your credit report for up to five years.

Soft enquiries, however, do not harm your credit score. Soft enquiries are when someone runs a credit check on you, but it’s unrelated to money. This could be a pre-approved credit offer, or platforms like Tippla, that allow you access to your credit report for free.

Credit enquiries appear on your credit report because it gives lenders insight into your financial situation. If you have lots of enquiries on your credit report, it could symbolise that you are in financial difficulty and are likely to default on your repayments.

Few, or even no credit enquiries, could suggest that you are responsible with your finances. Whilst both of these scenarios might be false, or not paint the whole picture, this is what credit enquiries on your report may suggest.

According to Equifax, when it comes to credit enquiries, they will provide the following information on your credit report:

- Type of credit provider;

- The type and size of credit requested in the application;

- The pattern of credit enquiries over time.

Credit accounts

Similar to credit enquiries, and credit accounts that you currently have open will appear on your credit file. Are you currently repaying a loan? Do you have an active credit card? Then this will appear on your credit report.

Repayment history

Your repayment history is an important part of your credit report. Your repayment history is information that outlined whether you have met your credit payment obligations in a given month. Basically, your repayment history shows whether you paid the amount owing on your loan, credit card, etc by the due date.

Defaults

Similar to repayment history, defaults will also appear on your credit report. A default is a missed payment. According to the Office of the Australian Information Commissioner (OAIC), a credit provider can list a default on your credit report if:

- the payment has been overdue for at least 60 days;

- the overdue payment is equal to or more than $150;

- a notice has been sent to your last known address to let you know about the overdue payment and requesting payment;

- a second notice was sent at least 30 days later to let you know that if you don’t make a payment the credit provider intends to disclose the information to a credit reporting body;

- the credit provider must wait at least 14 days after issuing the second notice before listing the default.

Other negative entries

Your credit report can also contain other negative entries, if applicable. This can include bankruptcies, court writs or judgements.

Personal information

Not only does your credit report contain your credit history, but it also contains some of your personal information about your identity. This includes your name, address and date of birth. It won’t, however, include information such as your marital status or salary.

How long does information remain on my credit report?

Now you know what goes onto your credit report, let’s take a look into how long items stay on your credit report. As we highlighted at the beginning of this article, your credit report is an overview of your recent credit history.

It won’t contain all the credit information you’ve accrued over the past 10 years. Items do expire after a time. This is particularly beneficial if you have a poor credit history – you can work to improve it, and it won’t always be a black mark on your credit report.

Here’s typically how long items remain on your credit report:

- Credit accounts – your credit report will outline all of your current credit accounts, as well as any that you have closed in the past 2 years;

- Credit applications – any application you have made for some type of credit will remain on your report for 5 years regardless of whether you were approved or rejected;

- Repayment history – your repayment history over the past 2 years;

- Defaults – if you default on a repayment then it will appear on your report for up to 5 years;

- Court judgements and bankruptcies – 5 years;

- Serious credit infringements – these can stay on your credit report for up to 7 years.

Can I get information removed from my credit report?

If you notice a mistake on your credit report, then you can take steps to have it removed from your credit report. You can either reach out to the relevant credit provider, or you can reach out to the credit bureau themselves and ask them to handle the mistake.

However, if the information on your credit report is correct, regardless of whether the information is negative and harms your credit score, it can’t be removed. You will need to wait for the allotted time period for that information to expire from your credit report.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

No Credit Score? How to Build a Credit History From Scratch

18/07/2023

No credit history? No problem! You can build a...

The Effects of Multiple Credit Enquiries on Your Credit Score

28/07/2023

Credit scores play a crucial role in determining an...

Should I get a student bank account?

28/07/2021

Student bank accounts are essentially the same as any...

Understanding Compound Interest in Savings

27/03/2024

Ever wondered how your savings account can grow over...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog