Published in September 28, 2021

How Often Does My Credit Score Change?

There are a number of things that can affect your credit score, either positively or negatively. But what a lot of people don’t know is how frequently their credit score can change. We’ve got the answer for you below.

We have covered what can affect your credit score frequently here at Tippla. But one question we get asked a lot is “how often does my credit score change?” You asked, so we have answered!

Who calculates your credit score?

Your credit score is a number ranging from 0 – 1,200. In Australia, your credit scores are calculated by three companies – Equifax, Experian and illion. These three companies are known as credit bureaus or Credit Reporting Agencies (CRAs).

Equifax, Experian and illion collect your credit information from credit providers across Australia. Credit providers can be banks, non-bank lenders, credit unions, utility companies and more.

The credit bureaus in Australia collect your credit information and use it to create your credit report. Your credit report is a document outlining your recent credit history. The information on your credit report is used by each of the CRAs to calculate your credit score.

Because there are three credit bureaus in Australia, you have three separate credit scores and reports – one with each credit bureau. Your credit scores and credit reports can vary among the credit bureaus. For a full breakdown of why that’s the case, take a look at our guide outlining why your credit scores are different.

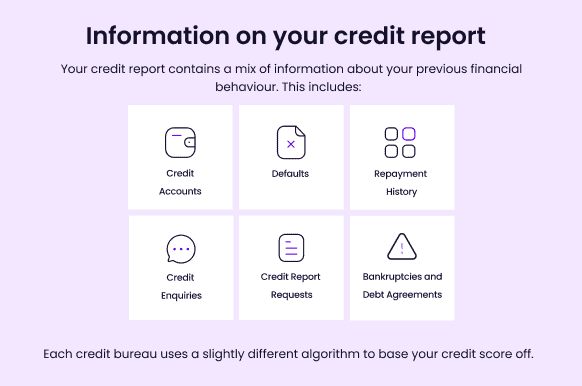

What information goes onto your credit report?

Your credit score is calculated using the information on your credit report. But what exactly is this information? To put it simply, it’s your recent credit history. When you take out a loan, credit card, utilities, post-paid phone plan and more, this is a type of credit. The way you manage that credit is what goes onto your credit report.

Specifically, here’s what information goes onto your credit report:

- Credit accounts – if you currently have a loan, an active credit account, or a post-paid phone plan, then this is referred to as a credit account. Your credit report will list all of your open (current) credit accounts, as well as any accounts you have closed in the last two years;

- Credit enquiries – whenever you apply for credit, this is called a credit enquiry. Credit enquiries will appear on your credit report for up to five years;

- Repayment history – each time you make your fortnightly or monthly repayment for your loan, credit card, phone plan, or utilities, this is your repayment history. Your repayment history over the last two years will appear on your credit report.

- Defaults – just like your repayment history appears on your credit report, so do your defaults. If you default on a repayment, then this will feature on your credit report for up to five years.

- Negative entries – Negative entries can include court judgements, bankruptcies and serious credit infringements. Depending on the information, it can appear on your report for typically five to seven years.

- Personal Information- Name, address, date of birth and employment.

- Credit Report Age – How long you have held a credit history.

How do credit bureaus get my credit information?

So how exactly do the credit bureaus get your credit information? They get it from the source. If you have a credit card with a bank, then each month, that bank will send your updated credit information to the credit bureaus. This goes for all credit providers.

That information can be anything that we outlined above – your repayment history, whether the account is open or you closed the account within the month and more.

When exactly credit providers send the information will depend on the company. Some might create their reports at the beginning of the month, some could send it towards the end. The timing will depend on their own reporting procedures.

It’s important to highlight here that credit providers don’t necessarily send your credit information to all three of the credit bureaus. Whilst some banks and credit providers will report your credit information to Equifax, Experian and illion, some might only report to one or two of the credit bureaus. That’s one of the reasons why your credit score can vary among the CRAs.

How often do credit bureaus update my credit report?

Because the credit bureaus receive new credit information each month, your credit report is updated around once a month. Each time your credit report is updated, the new information will be added to your credit file.

Furthermore, all of the information on your credit report expires after a certain time. Sometimes when your credit report is updated, some information may be removed from your credit report because it has expired.

How often does my credit score change?

Your credit score is based on your credit report. Therefore, because your credit report is updated on a monthly basis, then your credit score can change each month. Whether your credit score changes will depend on what new information the bureau receives.

If any negative information has been reported to the bureaus over the past month, then your credit score might have dropped. Or, if positive information is reported, or previous negative entries expire on your credit file, then your credit rating could have received a boost.

How often does my credit score change on Tippla?

On Tippla, we get your credit report and credit score information directly from Equifax and Experian every 90 days. We refresh your credit reports every three months, based on the information provided to us by the two credit bureaus.

Therefore, if you take out a new type of credit, such as a credit card, or a negative entry is set to expire, this may not appear on your credit report straight away. The information will be updated whenever the latest 90 day period has ended.

What if there’s a mistake on my credit report?

Sometimes, new information will be added to your credit report but it won’t be correct. This can happen for a number of reasons, but it’s actually quite common. 1 in 5 credit reports have some kind of mistake on them.

So what can you do if there’s a mistake on your credit report? Firstly, don’t panic. You can get mistakes removed from your credit file. There are two steps you can take to have a mistake removed from your credit report.

- Reach out to your credit provider – if the mistake involves a credit provider, such as an incorrect default, a credit enquiry you never made, or an issue with your credit accounts, then you can reach out directly to the company involved. If they agree that a mistake has been made, then they will alert the credit bureaus of the mistake and your credit report will be updated.

- You can also reach out to the credit bureaus directly and ask them to handle the issue.

If you want to reach out to Equifax, you can request a correction to your credit report here. If it’s Experian you want to handle the mistake, then you can send them an email at this address creditreport@au.experian.com.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

What happens when your car gets written off in an accident?

28/07/2021

What happens when your car is written off? Having...

Financial Planning for Millennials

16/02/2024

In today’s fast-paced world, young adults face unique financial...

9 Essentials To Have For Every Start-Up Business In Australia

11/07/2024

There’s no two ways about it: starting a new...

What is Credit Repair? How to Fix Your Credit Score

19/10/2021

Mistakes on your credit reports can be quite common....

Subscribe to our newsletter

Stay up to date with Tippla's financial blog