Published in October 25, 2021

What are the Different Types of Personal Loans?

There are many different personal loan options available for you on the market.

Are you looking for a personal loan but you’re not sure which one is right for you? Tippla has put together this helpful guide on the different types of personal loans.

What is a personal loan?

A personal loan is an amount of money that you can borrow from a financial institution such as a bank, non-bank lender, credit union, etc. You can use this money to pay for a range of personal expenses, such as:

- Medical expenses;

- Weddings;

- Vacations;

- Funerals;

- Large purchases, such as a television;

- Emergency expenses;

- Home renovations.

Typically, with a personal loan, you will borrow a set amount of money, and you will need to repay this amount in full, plus interest, over a set period of time. Some lenders may also charge fees for personal loans, which you will have to pay.

Why would you take on a personal loan?

Because you can use a personal loan to cover many different expenses, there are a number of reasons why you might take on a personal loan. This could be to cover an unexpected expense, make a large purchase, or help pay for an event – such as a wedding, funeral or vacation.

Basically, if you have a large expense, then you might want a personal loan to help pay for it.

Where can you apply for a personal loan?

Now you know the what and the why, let’s look at where you can apply for a personal loan in Australia.

Of course, banks are still one of the largest players in the game. But, you can also get personal loans from many non-bank lenders across the country. You can also apply with credit unions.

If you are looking for a personal loan, then Tippla has you covered! When you sign up for Tippla, you can access a range of personal loan offers that have been tailored to your credit score. When you fill out the application, you will be matched with a range of lenders who would be willing to lend to you based on your credit score.

Furthermore, there are many comparison websites that display a range of loans available if you want to look around for a loan. However, these sites might not show all of the options available on the market.

Am I eligible for a personal loan?

Whilst different banks, non-bank lenders and credit unions will have different lending requirements, there are some general criteria you will likely need to meet to be eligible for a personal loan.

The general criteria to be eligible for a personal loan is:

- You are over 18 years of age;

- Be an Australian or New Zealand citizen, Australian permanent resident, or have an eligible visa;

- Live in Australia;

- Be employed and receive a regular income;

- Not be going through the process of bankruptcy.

Each financial institution will likely have different minimum income and credit score requirements, as well as other criteria. Most lenders will require you to provide 90 days worth of bank statements so that they can assess your current financial standing and spending habits. That’s why it’s a good idea to do your own research before applying for a loan and make sure you’re confident you meet the requirements of the lender you’re applying with.

Different types of personal loans

Let’s dive into the different types of personal loans. You might be surprised to learn that not all personal loans are the same. In fact, there are several variations of personal loans. Tippla has compiled a list of the different types of personal loans.

Secured personal loans

One of the most common types of personal loans is secured personal loans. A secured personal loan is when you have a personal loan that has been secured with collateral. This is typically a vehicle (car loan), or with a house (a mortgage). But, with more types of loans coming to the market, other assets can be used to secure a personal loan.

With these types of loans, the asset acts as security, which is where the name “secured” personal loans comes from. Therefore, if you default on your loan, then your asset could be repossessed as a way to cover your repayments.

Typically, secured personal loans are easier to obtain from a reputable lender, because of the extra security. They typically come with lower interest rates and fees as there is less risk for the lender.

Unsecured loans

Unsecured personal loans do not have an asset attached to the loan. Because the lender is taking on more of a risk, you’ll likely be charged higher interest rates and fees than a secured loan.

An unsecured personal loan can be good if you don’t have an asset to use as collateral. However, you might have to convince the company you’re applying with that you’re a reliable borrower through proof of income, your credit score and other factors.

Fixed-rate personal loans

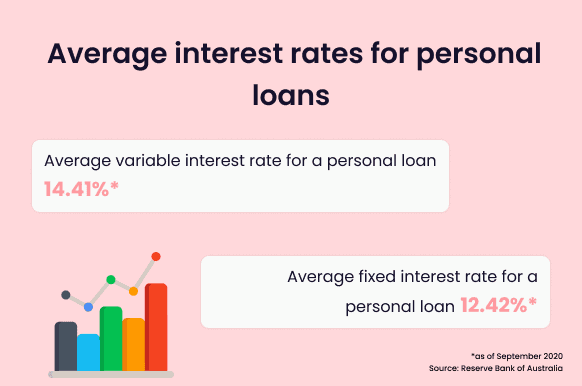

When it comes to personal loans, most of them come with a fixed interest rate which you will need to pay to the lender, on top of the amount you borrowed. What does this mean? The interest rate won’t change for the duration of your loan. This is called a fixed rate personal loan.

Having a fixed interest rate means you can easily budget your repayments, as they shouldn’t change each month. Because your interest rate won’t change, you can also protect yourself from having to pay more, should rates increase during your loan period.

Variable-rate personal loans

A variable-rate personal loan, on the other hand, is where the interest rate can change during the term of your loan. This could see your interest rate fall or increase, depending on the market.

Whilst a variable-rate interest loan can offer you more flexibility and allows you to capitalise on lower interest rates, it does also open you up to more of a risk of having to pay higher interest rates. Paying interest on your personal loan can cost you a lot in the long term.

Overdraft loans

A personal overdraft is kind of like a line of credit, which has been linked to your transaction account. If you run out of funds in your bank account, then the overdraft will activate, allowing you to have access to additional funds.

Similar to a personal loan, you will need to repay the money you spend when accessing your overdraft, plus interest. However, you will typically only be charged interest on the amount that you spend. Say your overdraft is $1,000 and you spend $100, then you’ll pay interest on the $100 you’ve spent – not the full $1,000.

Student loans

In Australia, if you are a citizen and want to study within the country, then you are most likely able to apply for Higher Education Loan Program (HELP), a government student loan.

As part of HELP (also referred to as HECS), the Australian government provides loans to students who are studying approved higher education courses. This means, they don’t have to pay for the course upfront. Instead, once their taxable income reaches a certain level, their repayments will commence.

If you are not eligible for this type of loan, or if you need further assistance for costs related to your study, then there are other options available. Some lenders will offer student-focused personal loans, where the money borrowed must be used for costs associated with your education.

Debt consolidation loans

If you have multiple debts, and you want to pay them off, you can take out a debt consolidation loan. The idea is, you take out one loan, and you use it to pay off your existing debts. Then you only need to focus on repaying one debt.

Some of the benefits of a debt consolidation loan include potentially getting a lower interest rate, and the convenience of only having to manage one debt, instead of several. However, a debt consolidation loan isn’t a one-size-fits-all solution. Taking on a debt consolidation loan could put you into a more difficult financial situation.

If you’re unsure what’s the best option for you, it’s a good idea to reach out to a financial counsellor. You can speak to a counsellor for free, independent and confidential financial advice.

Summing it up

As it can be clearly seen, there are many different types of personal loans. This includes secured and unsecured personal loans, fixed-rate and variable-rate personal loans, overdraft, debt consolidation and student personal loans.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

Dealer financing vs getting a car loan from a financial institution: Which is best for me?

28/07/2021

Which financial institution is more cost-effective? There are pros...

How Is Interest Charged For Personal Loans?

22/10/2021

It can be difficult to understand how interest works...

Navigating Credit Enquiries During Financial Hardships

14/08/2024

Credit enquiries, or credit checks, occur when a financial...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog