Published in October 9, 2024

No Credit Score? How to Build a Credit History From Scratch

No credit history? No problem! You can build a credit history from scratch. Here’s a helpful guide to help you do that.

Starting to build a credit history from scratch can be daunting at first. There’s a lot of questions you might have – what should you do first? What’s good for your credit rating? We’ve got your back. It’s not as hard as you may think and it should only take a few months until you’re fully set up.

First things first: Not having a credit score at all is better than having a negative score. If you need to build your credit score from scratch, you will need a few months to get there but you should see positive results quickly. Repairing a damaged credit score, on the other hand, can take years.

The goal: Aim for the best! Your goal should be an exceptional credit score! (Of course, good does the job, too.)

Not having a credit score yet means that the major credit bureaus don’t have any data about you listed just yet. Your goal is to build a history of positive entries in your file that allow you to apply for anything you want in the future.

Ready to get started? You will need a little bit of patience until you see results. Experian, one of Australia’s big credit bureaus says that it takes between 3 and 6 months until they have collected enough data to calculate a score for you. So make your next 6 months count (and all your financial decisions afterwards)!

What’s covered in this article?

Credit Score Basics

What is a credit score?

How does it work?

Why do I have no credit history?

How do I find out about my score?

Let’s get stuck in.

Credit Score Basics

Before you dive deeper into your finances, it’s important to understand how your credit scores work. Lesson number one: You have more than one credit score. That’s right, there are multiple bureaus that collect information about your financial behaviour. In Australia they are:

Each of them has its own reporting with slightly different parameters. That’s why your score can vary, depending on which report you’re looking at. Not everyone reports to all three of them in the same way and your information might be processed differently.

What is a credit score and how does it work?

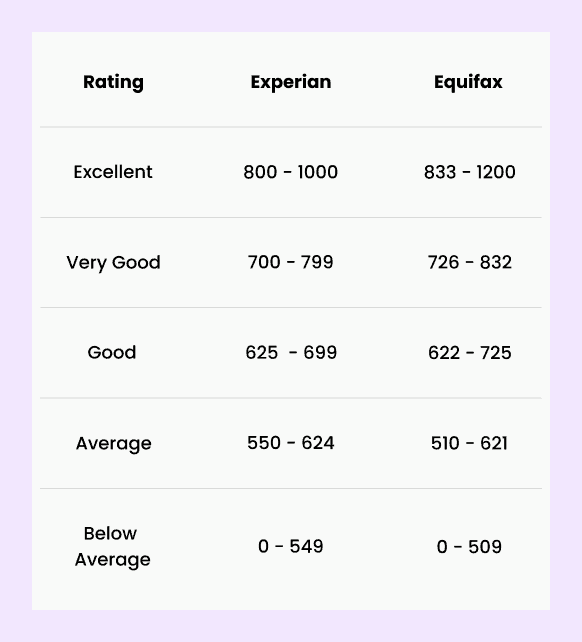

Your credit score is a number between 0 and 1,000/1,200 (numbers vary slightly for each credit bureau) that reflects your creditworthiness. It is based on your credit report, a collection of your credit data reported to this date. Your points place you in different categories:

Source: Experian and Equifax

While you should aim for an excellent credit score, reaching “good” is often enough to apply for a loan with good conditions.

If you apply for a mortgage, a personal loan, or a credit card in the future, your potential lender will perform a credit check and base their decision on your credit score. Higher scores can get you lower interest rates and better deals while loan applications with low credit scores may get higher interest rates or even get rejected.

What factors affect your credit score?

If you have to build your credit history from scratch, you may be wondering what your credit report is made of. Let’s have a closer look at its components.

Your credit score consists of a mix of things, including your previous payment history and how much you owe in comparison to the maximum amount you could borrow. You may be surprised to hear that borrowing money isn’t necessarily a bad thing for your credit score, as long as you pay it back on time.

Your credit score consists of multiple factors:

- Credit Accounts;

- Repayment History;

- Defaults;

- Credit Applications;

- Bankruptcies and Debt Agreements;

- Credit Report Requests.

Credit Accounts

If you have applied for credit in the last 2 years, it will be listed here. What type of credit did you have? Who is your credit provider? What is or was your credit limit? When did you open the account, when did you close it? If you applied for joint credit, the co-applicant would be listed as well.

This is something you want to consider on your journey to a healthy credit score. A healthy mix of different types of credit will give you a better score. This could be e.g. a personal loan, a car loan, and a credit card. Simply having multiple credit cards won’t give you the same effect on your credit score. However, whilst a mix of credit is good for your credit score, it is worse to take on too much credit and default on your repayments. You should only take out what you can afford. And here’s a tip for business owners: try to build relationships with Tier 1 business credit vendors. These vendors are important for creating a strong business credit profile because they usually report payment activity to major credit bureaus. By using credit from these vendors responsibly and paying on time, you can improve your business’s credit score and open up better financing options later on.

Tip: Wait a few months between applications if you are in the process of establishing a good credit mix. When you apply for a loan or type of credit, the credit provider will check your credit report to assess your creditworthiness. This is called a hard enquiry. Multiple hard enquiries in a short time will negatively affect your credit score. Additionally, you want your score to recover before you send your next enquiry to get you the best interest rate possible.

Repayment history

Your repayment history shows if you have paid your debt on time. It is an extremely influential factor for your credit score. Your credit report will include:

- Repayment amount;

- The due date for payment;

- How often you have paid and if your payment was on time;

- Missed payments (payments not made within 14 days of due date);

- Did you make missed payments later?

Tip: Set up automatic payments to ensure that you always pay your debt on time. If you can’t set up autopay, set a reminder in your calendar. Missed payments can hurt your credit score for years.

Defaults

A default is a non-payment of debt of $150 or more. This includes any phone or utility bills, credit card bills, or loans that you didn’t pay on time or in case of a clear out. (A clearout = when a credit provider can’t contact you at all).

A default will be listed if the payment is 60 days or more past its due date or the provider has asked you by phone or in written form to make your payment.

Credit Applications

When you apply for any form of new credit, a hard inquiry is registered. This can have a short-term effect on your score. Too many hard inquiries at a time will negatively impact your numbers. Your credit reports lists:

- Number of Applications;

- Total Amount of Credit;

- Loans.

Other factors that impact your credit score

While you are building your credit score from scratch, you won’t have to worry too much about these things. However, it’s good to know what could impact your score down the track!

- Public records such as bankruptcies;

- The number and residency of credit accounts you have applied for;

- Cross-referenced files (additional credit files that contain similar information but vary in data-points);

- Default listings with debt collectors.

Why don’t I have a credit history?

So far, your credit history is blank and you might be wondering why? There could be a few reasons why. If you just turned 18 and most of your bills have been paid by your parents, you haven’t had a chance yet to accumulate credit history. Even if you are older, chances are that you never applied for credit yet and therefore, the relevant credit bureaus don’t carry data about you.

How to build a credit history from scratch

If you want to build a credit history from scratch, here are some of the steps you could take.

Step one: Open an Australian bank account

Let’s start to build your credit history from scratch. If you don’t have your own bank account yet, that’s the first thing you want to look into. A long-held bank account may allow you to apply for a credit card down the track. While it may not help you immediately to improve your credit score, it could in the future. A bank you had an account with for some time may be able to offer you a credit card based on your previous relationship. Having a bank account will also allow lenders to verify your residency once you start applying for personal loans. You will often be required to provide multiple documents that have your address on them.

Additionally, a bank account is important to manage your finances well and on time.

Step two: Proactively provide information

You can proactively approach your credit bureau to provide information if your data is currently left blank. While you can’t just send them an email to get listed, you can send them

- A document to prove your identity;

- A document to prove your address.

Updating your information proactively will be useful for future reference. E.g. if you apply for new credit after you moved house and your address doesn’t match, this can affect your credit score by creating a cross-reference or even a new credit file.

Now there is some information about you in the system. Just because you never had a credit card or a loan doesn’t mean you don’t have a positive financial history. Let’s start your efforts to build a credit history from scratch.

If you live on your own, you may be reliable for paying rent and utilities. By making those payments on time, you have already proven that you can manage your finances well. If you have just started to live on your own, keep in mind that paying your bills on time may affect your credit score in the future. The earlier you start building healthy financial habits, the better.

Step 3: Apply for a credit card

While you may not be able to apply for a regular credit card with no credit score, there are other options available to you.

-

- First credit card. Many banks offer specific credit cards for people that are just starting out with their financial life. They generally come with low fees and low interest.

- Guaranteed approval credit card. As the name suggests, you will get approved for this credit card even if you don’t have a credit score yet. It comes with a higher interest rate, a lower credit limit, and fewer features. However, if you pay off your spendings every month, the interest rate won’t matter and can help you build a positive credit history.

- Use a co-signer. Adding a co-signer to your application can improve your chances of getting approved. However, some big banks won’t allow it. Be careful who you choose, a co-signer will be legally responsible for any debt you accumulate on that card and will equally be able to access your funds. A co-signer should be someone you trust like a parent or a close family member.

- Open a joint credit card. On a similar note, you may have better chances to open a joint bank account with a partner or a family member if they have a good credit rating. A joint account comes with joint responsibilities but also joint benefits. Did you move into your first place? How about a joint credit card to pay for house expenses? You will all benefit if everyone treats it responsibly.

- Be an authorised user for some else’s account. If you want to build a credit history from scratch, this is something you can always do. Most credit cards allow you to add authorised users. They are different from a co-signer because the responsibility to pay the bills stays with the primary owner of the credit card.

Step 4: Work on your credit mix

When you’re a few months into building your credit history from scratch, you should have a credit score and it’s hopefully looking good. The next step you could take to developing your credit history is by thinking about other credit options if you can afford them. A healthy credit mix contains both types of credits:

- Revolving credit – a revolving credit doesn’t have an end date and is a consistent line of credit like e.g. a credit card. It doesn’t have a specific limit but comes with minimum payments each month.

- Instalment credit – on the contrary, instalment credit has a set amount and an end date. Examples are personal loans, student loans, or car loans.

Credit bureaus recommend having a blend of different credit types in your credit history.

Let’s say you are considering buying a car, it may be sensible to look into your loan options even if you could afford to pay the full price. Starting your credit history with a car loan may be a good idea. Most car loans are secured loans. Your purchased vehicle acts as security against the loan and allows your lender to offer you a better interest rate.

However, it is possible to build a credit history from scratch with a good score even if your credit mix consists of one sort of credit only.

Actions that positively impact your credit history over time

- You can ask your bank for a small overdraft. It allows you to borrow extra money from your bank account. While you won’t actually have to make use of it, it will still impact your credit score as it is a form of credit;

- Make sure all your utilities and household bills are in your name. While it may be difficult to set up all of them under your name if you don’t have a credit score, it will get easier over time. It’s important for your future history to have them in your name;

- Always pay direct debit when possible;

- Don’t apply for multiple credit accounts at the same time. If you are currently working on building a credit mix, space out your applications. Each application will create a hard enquiry that may cause your credit score to drop for a few weeks;

- You don’t have to pay interest on your credit card to help your score. In fact, it is better to pay off your credit debt straight away each month. If you pay off what’s due you’ll build up your credit history without having to pay extra;

- Don’t close accounts unless you really don’t use them anymore. The longer you own an account, the better it is for your credit history.

Want to learn more about your credit score? Tippla’s credit school may be of great help! Simply sign up with us today to access our free resources that can give you further guidance about your credit score and ways you can build and improve it.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

What Are The Different Types of Credit Cards?

07/09/2021

With so many options out there on the market,...

Do I need a new driver’s license when I move in-state?

28/07/2021

If you plan to move in-state, you should update...

What is Credit Repair? How to Fix Your Credit Score

19/10/2021

Mistakes on your credit reports can be quite common....

Does Your Personal Information Affect Your Credit Score?

25/10/2021

Your credit score is an important number – it...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog