Published in September 14, 2021

Why Has My Credit Score Fallen? Here are 3 Reasons

Have you noticed a drop in your credit score? You might be wondering why it has fallen - Tippla has put together a number of reasons why that might be.

Your credit score is an important number and can have far-reaching implications. Today, Tippla is going to answer the question “why has my credit score fallen”, but first, let’s go over some important information.

What is a credit score?

A credit score is a number ranging from 0 – 1,200. This number is a representation of your creditworthiness (translation: how reliable of a borrower you are). In Australia, your credit score is calculated by three credit bureaus – Equifax, Experian and illion. Therefore, you have three unique credit scores and credit reports.

Why is my credit score important?

You might be wondering why is your credit score important. Putting it simply, when you apply for some kind of credit, such as a loan, credit card, utilities and more, your credit score is one of the factors that lenders look at when deciding whether to approve or reject your application.

Whilst it isn’t the only factor that lenders consider – it is an important factor. Having a good credit score could be the difference between you being approved or rejected.

Not only that, but your credit score can influence the finance available to you. If you have a bad credit score, then you will likely be deemed as a higher risk. Because of this, credit providers will typically only offer you products with higher interest rates, lower borrowing limits, and stricter conditions in a way to offset the risk they perceive you to be. Therefore, you will likely have limited choices that can be more costly than if you had a good credit score.

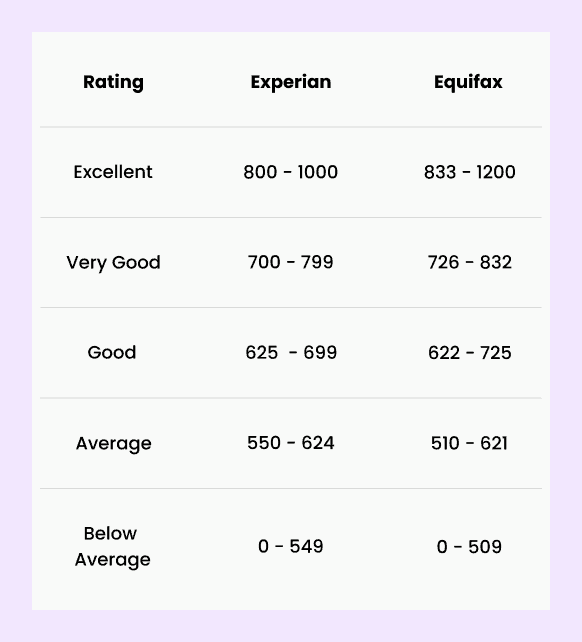

Not sure what is a good credit score? Equifax and Experian calculate your credit scores differently. Here’s how they categorise credit scores:

Source: Experian and Equifax

How is a credit score calculated?

Let’s take a quick look at how credit scores are calculated. Whilst the exact formula of how credit scores are calculated remains a well-guarded secret, and each of the bureaus uses different algorithms to calculate your scores, we do know a few things.

Namely, your credit score is calculated based on the information on your credit report. The information on your credit report is what affects your credit score.

Here’s what goes onto your Equifax credit report:

- Type of credit provider

- The type and size of credit requested in the application

- Number of credit enquiries and shopping patterns

- Directorship and proprietorship information

- Age of your credit report

- The pattern of credit enquiries over time

- Personal information

- Default information

- Court writs and default judgements

- Commercial address information

Here’s what goes onto your Experian credit report:

- Type of credit provider

- Type of product that was applied for

- Repayment history

- The credit limit on each of the credit products

- Amount of credit enquiries

- Any negative events

How Equifax calculates your credit score

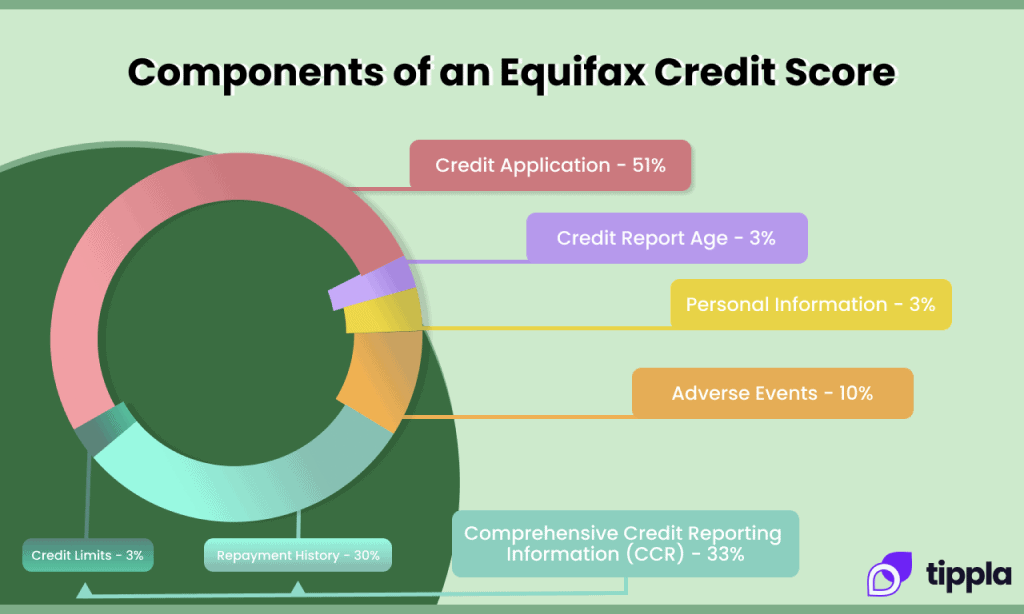

The credit bureaus use this information on your credit report to calculate your credit score. Equifax has given us the below information into how they typically calculate a credit score:

Source: Equifax

How Experian calculates your credit score

Experian, on the other hand, has outlined the following: “Your Experian Credit Score is calculated by applying a statistical algorithm that uses past events to predict future behaviour. Each credit bureau uses a slightly different algorithm and does not disclose in detail how this is calculated.”

However, the credit agency has outlined the following as key attributes it uses to generate your credit score:

- Type of credit providers that have made enquiries on your report

- The type of credit you have applied for

- Your repayment history

- The credit limit of each other credit products

- Negative entries

- The number of credit enquiries (credit applications) you have made

Why has my credit score fallen?

Now you know what information goes onto your credit report, and therefore, what can influence your credit score, let’s now tackle the question “why has my credit score fallen?”.

Unfortunately, there is no single reason as to why your credit score could have fallen. The exact reason will depend on your personal circumstances. However, there are a number of things that can harm your credit score. Let’s look at these first.

Firstly, let’s see what harms your Equifax credit score:

- Late repayments

- Applying for a large amount of credit in a short period of time

- Closing a credit account

- Stopping credit-related activities for an extended period

- Negative public records, such as bankruptcy

And now let’s check out what harms your Experian credit score:

- A large number of credit applications in a short period of time

- Open accounts with debt collection agencies

- Short term credit

- Missed payments

- Bankruptcy actions

- Defaults

- Court judgements

Common reasons why your credit score could have fallen

So what are some of the common reasons why your credit score has fallen? We’ve put together a list below. Whilst this list gives a good overview, it is not exhaustive, and might not apply to your individual situation.

- Making too many credit applications in quick succession – have you recently applied to multiple lenders for a loan, a credit card, or some other form of credit? Each time you apply for credit, it registers as a hard enquiry on your credit report and lowers your credit score.

- Defaulting on a credit repayment – did you miss a repayment on your loan or credit card? This could appear on your credit report as a default and harm your credit score;

- Having too many credit accounts open – if you have multiple loans, or multiple credit cards, as an example, open in your name then this could be harming your credit score. Having too many credit cards can indicate that you are in financial distress and therefore, are a risky borrower;

For a more in-depth guide on negative entries that can harm your credit report, check out one of our recent articles on negative entries on your credit report.

Can I improve my credit score?

Yes, you can improve your credit score! Whilst it won’t necessarily be an overnight fix, it can be done, and most of the fixes can be done yourself for no cost at all. If you’re thinking of paying a company to help you fix your credit report, then check out our article on whether credit repair companies are worth it.

Here are some things you can do to improve your credit score.

Space out credit applications

Every time you apply for credit, with limited exceptions, the company you are applying with will check your credit report to get an overview of your credit history and determine if you are a risk. This is called a hard enquiry.

A hard enquiry harms your credit score. Therefore, in order to limit the damage to your credit score, the fewer applications you make, the better. That doesn’t mean that you shouldn’t ever apply for credit, but instead, do your research beforehand and find the best deals suited to your requirements, and check that you meet the eligibility criteria.

Don’t take on too much credit at once

Having multiple loans, credit cards or a mixture of multiple credit accounts can be damaging for your credit score. Why is this? Because it can appear like you are in financial distress. Therefore, one way you can avoid having too many credit accounts open at once is to only take on credit when you really need it, or there is a clear purpose for the credit.

Make your repayments on time

As we highlighted earlier, repayments decently contribute to your credit score. Therefore, in order to improve your credit score, or maintain a good credit score, you should ensure that you make your repayments on time.

Displaying that you can effectively manage your credit can go a long way in proving that you are a reliable borrower and therefore, have high creditworthiness.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Subscribe to our newsletter

Stay up to date with Tippla's financial blog