Published in September 13, 2021

What Affects My Credit Score? A Quick Guide

Whether you’re applying for credit or simply want to know more, we hear you, and we’re here to answer the age-old question of what affects my credit score? Tippla has provided a breakdown below.

What is a credit score?

Before answering “what affects my credit score”, let’s first discuss what is a credit score? Your credit score is a number that ranges from 0 – 1,200, based on the information contained within your credit report. Your score falls somewhere on a five-point scale ranging from below average up to excellent. Your credit score indicates to lenders your creditworthiness; the higher your score, the more reliable you appear to a potential lender.

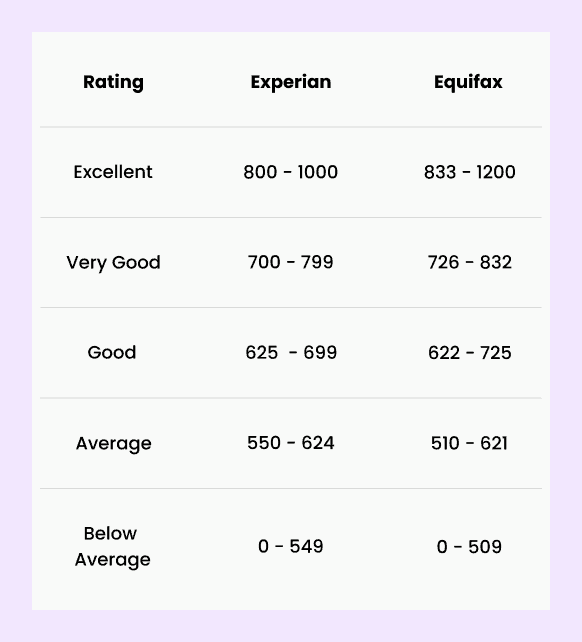

What is a good credit score?

Due to Experian and Equifax calculating your credit score differently, the categorisation of the “below average” to “excellent” scale differs between the bureaus.

Source: Experian and Equifax

What’s the difference between a credit score and a credit report?

Your credit score is a number falling somewhere between 0 – 1,200, depending on the reporting agency. In contrast, your credit report includes detailed information regarding your credit history. Your credit score is calculated based on the information contained in your credit report. If you’re still confused about “what affects my credit score”, it’s the information contained within your credit report.

What goes onto your credit report

Many things go onto your credit file, and all of this information will have some kind of impact on your credit score. It’s not just your credit accounts that appear on your report; phone bills, personal loans, and payments to utility companies will also feature on your report.

Your personal finances, such as checking and savings accounts, have little to no effect on your credit score, as your credit report is only concerned with the money you owe or have previously owed. However, in some unique situations, your personal finances may be affecting your credit score.

What affects my credit score?

In Australia, you have three different credit scores; here at Tippla, we provide you with your Equifax and Experian scores. It’s important to note that these scores may be slightly different, as they are scored on different scales and attribute different values to the contributing factors.

Here’s what goes onto your Equifax credit report:

- Type of credit provider

- The type and size of credit requested in the application

- Number of credit enquiries and shopping patterns

- Directorship and proprietorship information

- Age of your credit report

- The pattern of credit enquiries over time

- Personal information

- Default information

- Court writs and default judgements

- Commercial address information

Here’s what goes onto your Experian credit report:

- Type of credit provider

- Type of product that was applied for

- Repayment history

- The credit limit on each of the credit products

- Amount of credit enquiries

- Any negative events

What harms my credit score

When understanding what affects my credit score, it’s equally important to look at what is also harming it. At Tippla, your reports come from the two leading credit bureaus in the world – Experian and Equifax, each of which considers different factors as detrimental when calculating your credit score.

What harms your Equifax credit score:

- Late repayments

- Applying for a large amount of credit in a short period of time

- Closing a credit account

- Stopping credit-related activities for an extended period

- Negative public records, such as bankruptcy

What harms your Experian credit score:

- A large number of credit applications in a short period of time

- Open accounts with debt collection agencies

- Short term credit

- Missed payments

- Bankruptcy actions

- Defaults

- Court judgements

It is essential that you check all your information listed in your credit report to make sure there aren’t any mistakes that could diminish your score. Specifically, check to see that any of the debts and loans are yours and your personal details such as your name and date of birth are correct. If you find any errors or out-of-date information, contact that credit reporting agency and ask them to fix the mistakes.

What improves my credit score

Whether you’ve just checked your credit score and it wasn’t quite as high as you expected, or maybe you just want it to be even better, you can take steps towards improving it when you know what affects your credit score. Maintaining a good credit score means that you are more likely to be approved for different types of accounts and are more likely to get better interest rates when applying for a loan.

When you receive your scores, you should also be able to see the risk factors impacting your score the most; from this information, you can see where changes should be made and make a conscious effort towards doing so. It should be noted that any actions you take won’t see immediate change, and you’ll need to allow time for your creditors to report your positive behaviour before it is reflected in your credit score.

Tips to improve your credit score

Changing your behaviour can help improve your score over time. You could start by paying your bills on time, as your previous payment history is an indication of your future performance. You could also ensure that you pay off debt and keep balances low on your credit cards and other revolving credit.

You could also improve your credit score by only applying for and opening new credit accounts as necessary. Taking on unneeded credit can damage your score by creating too many hard enquiries or simply tempting you to overspend and accumulate more debt.

In addition, applying for too much new credit can harm your credit score because it results in numerous hard enquiries, which remain on your report for two years.

How to fix my credit score

Now that we’ve answered the question of what affects my credit score? Let’s discuss how you can fix your score.

Credit repair companies offer to quickly fix your credit score by correcting the visible issues on your credit report. Unfortunately, many of the issues can’t be resolved immediately and are things you could do yourself (for free). By reading through your credit report and understanding your score’s contributing factors, you can change these behaviours to prevent yourself from a further decline.

An important thing to remember is the time taken to fix your credit score can vary, depending on how severe the negative entry is:

- Enquiries remain for two years.

- Late repayments can take seven years to leave your credit report.

- Public record items can remain on your report for seven years, but some cases of bankruptcy can stay for ten years.

Rebuilding and improving your credit score does take some time, and there aren’t really any shortcuts you can take. One of the best steps you can do is to check your credit scores with Tippla today; from there, you can review which factors negatively affect your score and then head over to the Tippla Credit School to learn more about improving your rating.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

Should I get a student bank account?

28/07/2021

Student bank accounts are essentially the same as any...

How to Use Credit Cards Effectively: A Guide

07/09/2021

Millions of Australians have some kind of credit card....

Tips and Strategies to Minimise the Negative Effects of Credit Enquiries in Australia

11/10/2023

Managing your credit is crucial for getting loans or...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog