Published in July 29, 2021

How to Reduce the Interest on Your Home Loan

When you take out a loan, you’re not only paying back the amount you’ve borrowed but the interest on top of the loan. This extra interest can add up over the long term. That’s why we’ve put together this helpful guide on how to reduce the interest on your home loan.

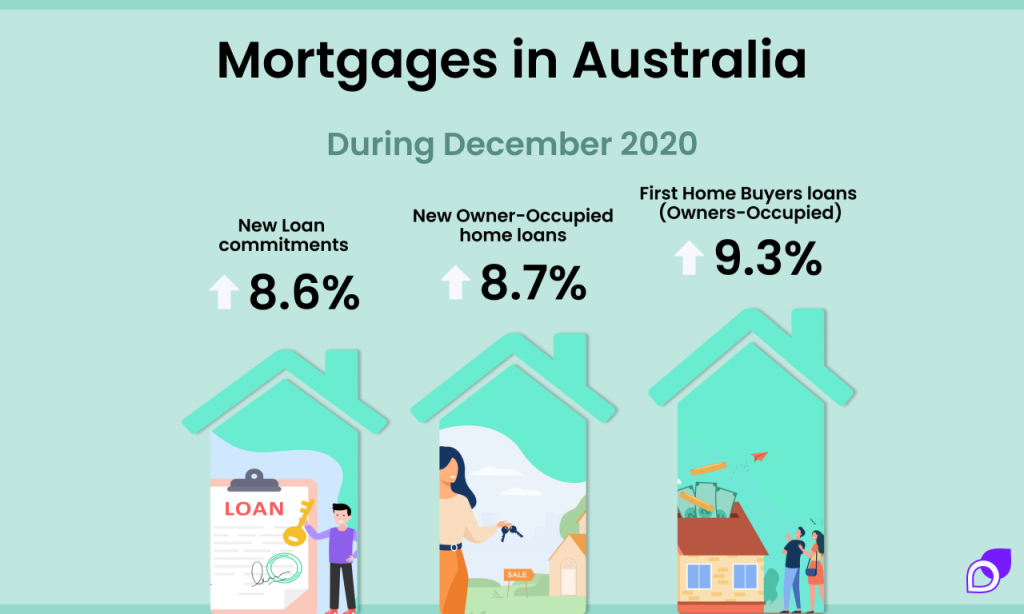

Mortgages in Australia

2020 was a good year for the housing market in Australia. According to the Australian Bureau of Statistics (ABS), the total value of new loan commitments for housing and the value of owner-occupier home loan commitments reached record highs in December 2020.

In the final month of last year, the total value of new loan commitments for housing rose by 8.6% from the previous month to reach $26 billion. This is an increase of 31.2% year on year.

For new owner-occupied home loans, these increased by 8.7 per cent in December to reach $19.9 billion. This is up by 38.9% year on year.

For first home buyers, the number of owner-occupied loan commitments rose by 9.3% to reach 15,205 for December 2020. This is stronger than December of 2019’s figure by 56.6%. According to the ABS, this is the highest level since June of 2009.

In Australia, there are two main types of mortgages – fixed interest rate mortgages and variable interest rate mortgages.

Fixed interest rate mortgages

A fixed interest rate mortgage, as the name implies, is when the interest rate of the mortgage stays the same for a set time. After this period is up, the rate will then change to a variable interest rate. Or you can speak with your provider about negotiating another fixed rate.

Some of the benefits of a fixed interest rate mortgage include consistency. It’s much easier to budget when you know exactly what your repayments will be. The downside of fixed interest rate mortgages is that if home loan rates drop, then you won’t benefit. On the flip side, if the rates increase, then you won’t have to pay extra.

Variable interest rate mortgages

If you take on a variable interest rate mortgage then your interest rate may either increase or decrease as the market changes. This could happen when the official cash rates change, for example. Whilst this type of mortgage could offer you greater flexibility, it can be harder to budget for.

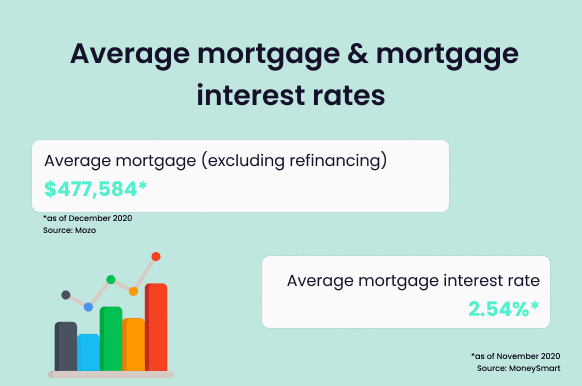

The average mortgage in Australia

Mortgage prices vary a lot in Australia. Many factors can influence the price of a mortgage. Are you buying a house, apartment, or unit? Are you buying in the city or in a rural area? Is the house new or old? These factors can influence the price of a property and the mortgage as a result.

But what is the average mortgage in Australia? According to Mozo, as of December 2020, the average mortgage (excluding refinancing) in Australia was $477,584.

As for the average interest rate, MoneySmart outlines that as of November 2020, the average mortgage interest rate was 2.54%. Therefore, if you have a mortgage of $477,584 for 30 years, then you’re looking at paying an extra $363,919 in interest.

How to reduce the interest on your home loan

There are a couple of ways you could reduce the interest on your home loan. Some of these can be done before you get a mortgage, and some can be done after. Let’s start with the things you can do before to reduce the interest on your home loan.

Shop around for the lowest interest rate on the market

When you’re buying a house, it’s important to do your research. Some people might go straight to their bank to ask for a home loan, but that isn’t necessarily your best option.

MoneySmart recommends that you should compare loans from at least two different lenders, but you could easily compare more to try and get the best deal. Whilst there are many comparison websites you could use to help you with this, it’s important to keep in mind that these businesses make money through promoted links and might not cover all of the options out there.

When comparing loans you should be aware of the interest rate vs. the comparison rate:

| Interest Rate | Comparison Rate |

| The interest rate shows how much interest you will be charged each year for the duration of your mortgage. | The comparison rate is the combination of the interest rate and most of the fees and charges that you will incur if you take on this loan. The comparison rate is a more accurate representation of how much extra you’ll be paying on top of the loan. |

Other things you should look out for and compare include:

- Monthly repayment

- Application fee

- Ongoing fees

- Loan term

- Loan features

Try to get the shortest loan term

When you take out a mortgage, you will be charged interest each year. The loan term refers to the period of time you will be repaying the home loan. Therefore, the shorter your loan term, the less interest you’ll need to pay. If you shop around and get a 20-year mortgage, as opposed to 25 or 30 years, you could save yourself big time in interest.

However, whilst you may save on interest big time, generally speaking, a shorter repayment period means that your monthly repayments are higher. If you’re thinking of opting for a shorter loan term, it’s a good idea to make sure you can comfortably afford the repayments. If you’re not sure what’s the best option for you, you can reach out to a financial adviser or to a mortgage broker, who can help you through the process.

Keep an eye out for mortgage features

When you take out a mortgage, your lender might offer you a range of different features, such as an offset account, line of credit facilities, and more. When looking at any offer with additional features, you might want to check whether you will use and benefit from them. This is because extra features often mean higher interest rates. So there’s no point getting a loan with extra features you won’t benefit from and it will just cost you more in the end.

Repay your mortgage fortnightly, not monthly

Generally, mortgage repayments occur monthly. However, one thing you could do to reduce the interest on your home loan is to make your mortgage repayments on a fortnightly basis instead and cut the amount in half.

Let’s say your mortgage repayment is $1,000 a month. Instead of paying that amount each month, you could pay $500 each fortnight. This way, you’ll end up paying more in the long run, as there are 26 fortnights each year (you’ll pay $13,000 instead of $12,000).

By putting more towards your mortgage, you might be able to repay it quicker than the loan period. This could save you from having to pay months, or even years, of interest. Before you do this, it’s a good idea to check the terms and conditions of your home loan to ensure that you can pay off your mortgage quicker, and change the repayment schedule, without incurring additional fees.

Round up your monthly repayments

Another way you could try and reduce the interest on your loan is to round up your monthly repayments. If your monthly repayment is an odd number, say $1,115, you could round this up and pay $1,200 each month instead. Similar to changing your repayment schedule to fortnightly, this method could also see you repaying your mortgage earlier, and saving you years of interest.

Again, it’s important to make sure the terms and conditions of your mortgage won’t penalise you for doing this. If you’re uncertain, you can speak to a financial adviser who can help guide you through your options.

Get a health check on your mortgage

Just like you get a check-up on your health, you can do the same thing with a mortgage. Home loans often come with features which you pay premiums for, such as an offset account. Numerous mortgage and financial companies advise that you review your mortgage regularly with an experienced mortgage broker. With their help, you might be able to save money by negotiating a better deal with your existing lender or get a new deal with a different provider.

Extra tip: Save a larger deposit to avoid Lenders Mortgage Insurance

In Australia, when you want to buy a house, banks and lenders typically require you to have a deposit that’s 20% of the property’s value. Let’s say the property is worth $500,000, then you’d need a deposit of $100,000.

Some lenders and banks will allow you to have less than a 20% deposit if you have sufficient income to support the loan. To offset the lower deposit, you will be charged a one-off premium to your home loan – Lenders Mortgage Insurance (LMI). You can also be charged a Low Deposit Premium (LDP).

LMI protects lenders against the risk of you defaulting on your home loan. The size of your LMI premium is based on the size of your deposit and how much you borrow. The bigger the deposit, the lower your LMI premium will be. According to the Commonwealth Bank, financial institutions will need you to take out LMI when there is an increased risk associated with your loan – ie. a deposit lower than 20%.

If you want to avoid LMI and LDP, then you could save up a bigger deposit. That way, lenders might not see you as a big risk. This could save you thousands of dollars.

How to reduce the interest on a home loan

Because home loans are often a long-term commitment, you can end up paying a lot in interest. So what are some of the key ways you can reduce the interest on your home loan?

Let’s sum it up for you:

- Shop around for the lowest interest rate on the market;

- Try and get the shortest loan term within your budget;

- See if bonus features are worth the cost;

- Repay your mortgage fortnightly, instead of monthly;

- Round up your repayments;

- Get a health check on your mortgage regularly;

- Bonus tip – avoid LMI if possible.

If you try and utilise any of these suggestions, you could save big time. Before you make any decision, you should always check to make sure you can afford it, and that it’s within your means. If you are unsure, you can consult a mortgage broker or financial adviser for advice. Either way, it’s good to know your options!

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

Bad Credit Loans | What Are They & How To Apply for Them

21/09/2021

If you have a below-average credit score but you...

What is forbearance and is it right for me?

28/07/2021

Forbearance is a type of loan assistance that aids...

How Credit Enquiries by Utilities Companies Affect Your Credit Score

16/01/2024

In Australia, it’s essential to understand how utility companies...

Credit Scores vs Credit Reports: Understanding the Difference in Australia

23/10/2023

Understanding the nuances of credit scores and credit reports...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog