Published in July 29, 2021

Does renters insurance cover power surge damage

Covering power surge damage

Insurance providers either reimburse or replace your belonging in the event of loss, theft or damage due to covered peril. What’s considered a covered peril completely depends on your insurance policy. Each peril will have certain coverage limits.

In the event of electrical appliances getting damaged from a power surge, you may still get help from your insurance provider. Although, that would depend on how the power surge occurred and whether you have any additional coverage.

When doesn’t renters insurance cover power surge damage?

Damage caused by power surges is not commonly categorised as a covered peril. Landlords usually have electricians assess any outlets throughout the year and before you move in. To be safe, you could always ask for surge protectors to be installed before moving in.

When do renters insurance cover power damage?

Although renters insurance doesn’t cover power surge damage, it usually does cover damage caused by lightning, as it’s considered a covered peril. The amount of coverage reimbursed completely depends on your policy’s limits. Insurance providers also cover short-circuit damage caused by electrical appliances, as they’d either lead to damage to your appliances or a fire.

The amount of coverage reimbursed also depends on your coverage limits. Renters insurance will also cover damage indirectly caused by a power surge. For example, if a surge that overloaded the wiring caused a fire, your insurance provider will cover the damage caused by the fire depending on your coverage limit.

How can renters insurance protect expensive electronics?

Most renters insurance policies only cover up to $2,500 of damaged electronics. If you own rather expensive electronics exceeding that limit, you should consider a few options to increase coverage.

– Additional Coverage: Additional coverage could insure your more valuable items. Depending on the event causing the damage, additional coverage could aid in raising the reimbursement cost, although this could increase your premium.

– Replacement cost rider: Replacement cost rider protects specific items. Even though it’s more expensive, it’ll guarantee you’ll have your item either replaced with a new one or one with equivalent value or fully reimbursed.

– At-home business rider: Regular renters insurance only covers personal items, not business items. If you run an at-home business, your equipment used to run your business will not be covered. This is when an at-home business rider could come in handy, especially if you have expensive commercial equipment on your property.

All-perils renters insurance policy vs. named perils renters insurance policy

Coverage for power surge damage might also depend on the type of perils outlined in your policy. There are two types of renters insurance policies: an all-risk policy or a named perils policy. An all-perils or all-risk renters insurance policy is a type of policy that covers all perils unless otherwise stated in the policy. This means only the excluded perils will be named in your policy.

An all-perils policy is usually more expensive than a named-perils policy because it’s more likely that you will suffer a loss that the renters insurance company will be responsible for reimbursing. It covers more perils than a named-perils policy.

There are still some exclusions when it comes to an all-perils or all-risk policy. Your policy could still exclude power surge damage as a covered peril from the policy, but it will have to explicitly it as an excluded peril. A named-perils policy is like the opposite of an all-perils policy: it only states what is included as a covered peril in your policy.

So unlike all perils, which only includes what is excluded, a named perils policy will outline all of the covered perils that are included should you need to file a claim. A named-perils policy will outline a comprehensive list of covered perils. Because named-perils are so specific about when a damaged or destroyed item will be covered, they end up being the cheaper option, sometimes saving people a couple of hundred dollars a year in premiums.

Plan a thorough budget with Moneysmart to understand your spending habits and how much you can afford for your monthly payments.

What does renters insurance cover?

Basic renters insurance policies are made up of several coverage policies for a range of losses. They cover:

– Your personal property: Your renters insurance policy covers both your liability as well as your personal property.

– Personal Liability and medical bills: This will cover the event of another person getting injured within your property, making you responsible for their medical expenses. You don’t need to be on the property at the time of the incident to get coverage.

– Temporary living expenses: If your home becomes inhabitable from damage, your insurance provider could pay for you to temporarily live elsewhere until your property becomes habitable again.

– Other types of coverage: You could add additional coverage for things that aren’t covered or considered covered perils.

Hungry for more?

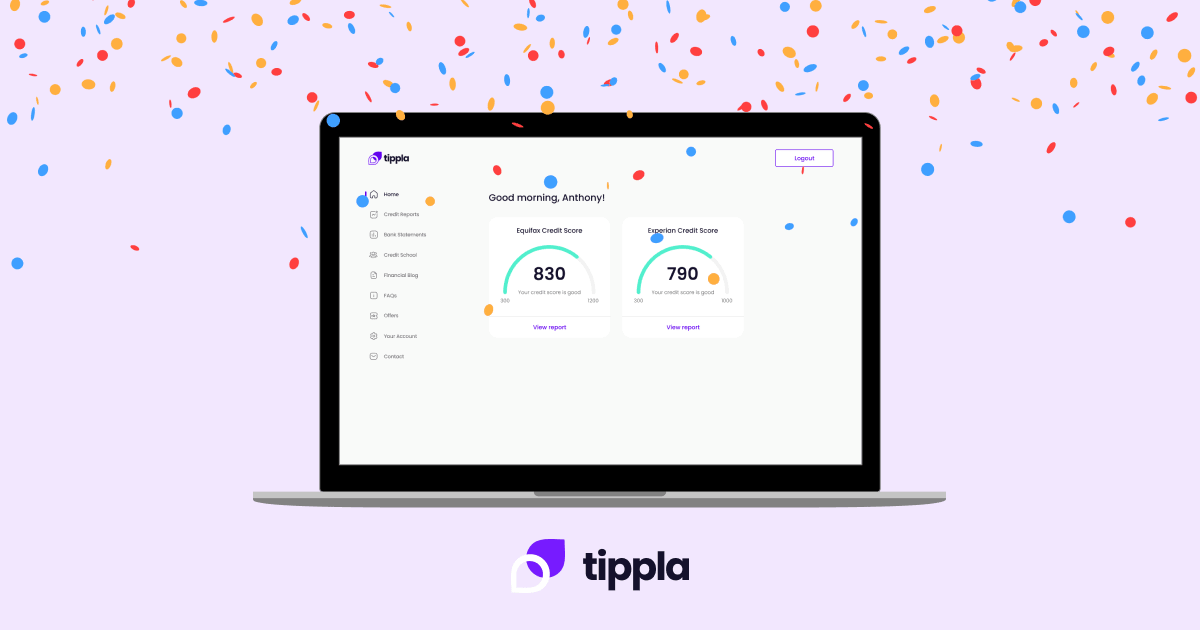

Sign up with Tippla today and get on top of your credit score. Your future yourself will thank you!

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

Tippla got a makeover – we’re back, and we’re better than ever!

24/08/2021

Tippla has rebuilt its platform from scratch, to give...

Checking accounts vs. Savings accounts

28/07/2021

There are a lot of similarities between checking and...

What Are the Consequences of Bad Credit? 5 Ways Bad Credit Could Impact You

28/07/2021

Looking out for your financial future Bad credit....

Subscribe to our newsletter

Stay up to date with Tippla's financial blog