Published in July 29, 2021

High credit scores and how to get one

What’s a credit score, how does it affect you, and how can you get a high credit score?

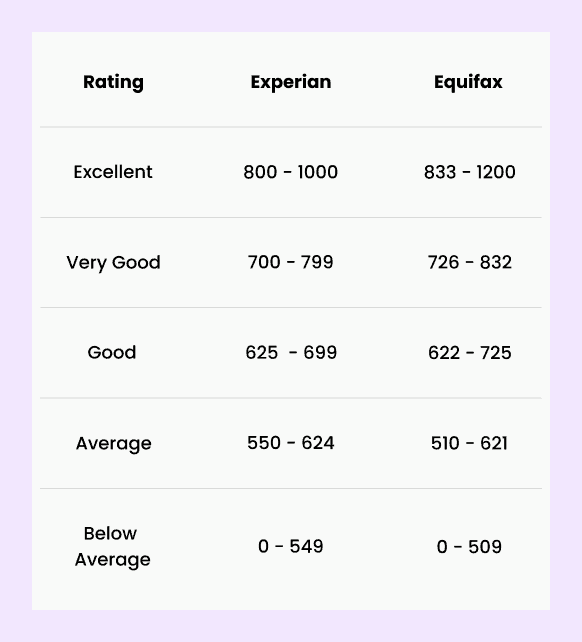

A credit score is a number that lenders use to determine someone’s creditworthiness. The higher your score is, the more reliable you are to receive and repay your loans. The scores usually reflect on a five-point scale (excellent, very good, good, average, below average).

Lenders and financial institutions check your score and history before offering you any type of loan. Generally, borrowers with higher scores qualify for lower interest rates. Therefore, it’s important to maintain the highest score possible to qualify for the best rates possible.

Scores range from 0 to 1200, with 1200 being a perfect score.

Source: Experian and Equifax

How many credit scores do I have?

You can find out what your credit score is within minutes with Tippla. All you need to do is sign up here.

Your credit report containing your debts and payments determines your current score. You will most likely have a credit report with agencies such as Equifax, Illion, Experian. That means you have three separate credit scores.

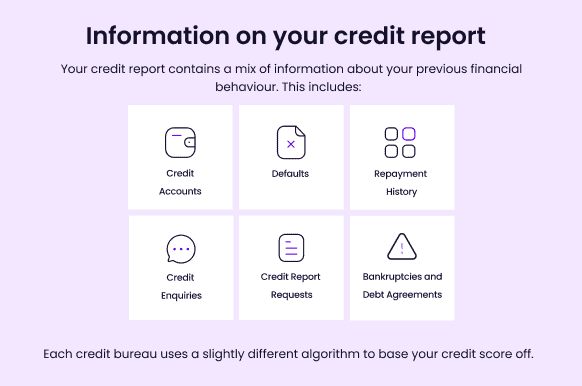

Your credit score is based on the information in your credit report. Here’s an overview of the information that goes onto your credit report:

Does having a perfect credit score matter?

Technically, it’s best to constantly improve your score. However, having a spot-on perfect score isn’t mandatory as you’d get good loan rates with a score of 600.

How to get a high credit score

Do you want a high credit score? It’s not out of reach! There are many ways to improve your score to get better rates. However, here are some ways to always maintain your credit score:

- Apply for credit only when necessary

- Pay your bills on time and in full

- Regularly review your credit report

- Keep your credit utilisation low

Learn more about how the accounts you hold can affect your score by signing up with Tippla.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

When Do Banks Do a Credit Check For Personal Loans?

19/10/2021

If you’re in the market for a personal loan,...

How To Check My Credit Report For Free

13/09/2021

Your credit report is an important document that gives...

Managing Multiple Credit Accounts

08/02/2024

Managing multiple credit accounts is a common financial strategy...

Credit Enquiries and Rental Applications

15/07/2024

Credit Enquiries and Rental Applications in Australia: What Tenants...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog