Published in August 16, 2023

How to Know if You’re Eligible for a Loan? Find Out with Tippla

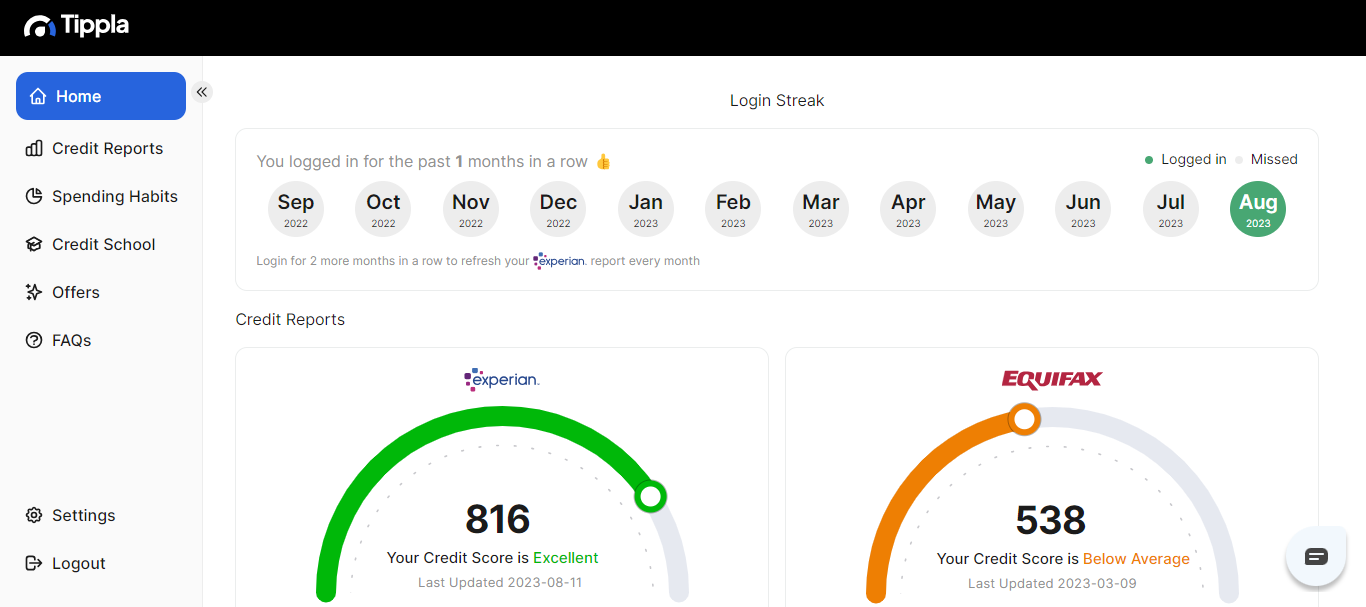

Tippla is a free online financial platform that enables users to monitor and track their credit scores conveniently through a single portal. Aside from credit checking and monitoring, Tippla also provides different loan options from a variety of legitimate lenders who specialise in personal loans, mortgage loans, and car loans.

Tippla’s technology compares credit scores from two of the three major credit reporting agencies in Australia (Equifax and Experian) to be able to come up with a personalised approach to assessing loan eligibility, allowing individuals to make informed financial decisions that align with their creditworthiness and financial goals.

Available Loans in Australia

In Australia, different financial institutions offer loans, including major banks, credit unions, and non-bank lenders. Different types of loans cater to different needs, and understanding their terms, interest rates, and repayment options can help you make an informed borrowing decision.

1. Personal Loans

Personal loans are a versatile financial tool that can be used for various personal expenses. They come in two main types: secured and unsecured loans, each offering distinct benefits and considerations.

- Secured Personal Loans: Secured personal loans require collateral, such as an asset (e.g., a car or property), which the lender can claim if the borrower defaults on the loan. These loans generally have lower interest rates due to the reduced risk for the lender. They are suitable for borrowers with valuable assets to use as collateral.

- Unsecured Personal Loans: Unsecured personal loans do not require collateral and are based on the borrower’s creditworthiness. As a result, they often have higher interest rates compared to secured loans. These loans are suitable for borrowers who don’t want to risk their assets as collateral.

Personal loans can cater to different borrowing needs with varying loan amounts, including:

- Small Loans: These are typically lower-value loans designed to cover immediate expenses or emergencies.

- Medium Loans: Medium-sized loans offer a bit more flexibility and can cover a broader range of expenses.

- Large Loans: Large loans are suitable for significant purchases, like funding a wedding or home renovations.

2. Mortgage Loans

Mortgage loans are loans designed to help individuals purchase real estate, usually homes. They are a type of secured loan, where the property being purchased acts as collateral. Mortgage loans have specific terms and repayment periods, often spanning several years. These loans can be either variable or fixed-rate, allowing borrowers to choose the option that suits their financial goals.

3. Vehicle Loans

Vehicle loans, often known as car loans or auto loans, help individuals purchase vehicles such as cars, motorcycles, or boats. These loans can also be secured or unsecured, depending on the lender’s terms. Interest rates and repayment periods vary based on the loan type and the borrower’s creditworthiness.

What Are the Loan Eligibility Requirements in Australia?

Loan eligibility requirements in Australia can vary based on factors such as the type of loan an individual is applying for, their financial situation, credit history, and the lender’s specific criteria. Different types of loans may have distinct eligibility criteria. Here are some general factors that lenders commonly consider when assessing loan eligibility.

Basic Requirements

- You must be at least 18 years old.

- You must be an Australian citizen, have Australian permanent residency, or have an eligible visa.

- You must be a resident of Australia.

- You should meet minimum income requirements and have a regular source of income.

- You need to have a good credit rating.

- You should not be going through the process of bankruptcy.

For personal loans

When you’re getting a personal loan, it’s important to ask for an amount that matches what you earn and can afford. Lenders look at how well you can pay back the loan given your current money situation. Showing you’re good with money and handling it wisely can make you more likely to get approved. This means being smart about what you do with your money now, paying bills when you should, and not spending more than what you have.

For mortgage loans

When you want to apply for a home loan in Australia, there are certain things you need to qualify for. Your financial situation may be assessed based on the number of people applying for the mortgage, your relationship status, and whether you have dependent children. They will also want to know about the property you want to buy – things like how much it’s worth, where it is, what kind of place it is, how old it is, and how big it is. Some lenders have rules about the types of properties they’re okay with using as a guarantee.

For vehicle loans

When you’re applying for a vehicle loan in Australia, besides meeting the basic requirements, you might also need to share details about the specific vehicle you want to buy. This includes things like the brand, model, and year of the vehicle. The lenders want this info to check how much the vehicle is worth, what condition it’s in, and if it’s a good fit to use as security for the loan.

How Can Tippla Help?

Tippla offers personalised loan offers to make the process of applying for a loan easier and faster. These pre-approved loan offers are based on your current credit scores and financial situation.

Below is a step-by-step guide on how you can use Tippla’s personalised loan offers. But first thing’s first, make sure you have already signed up to Tippla to access this feature. Sign up now if you haven’t yet!

Step 1: Go to the Dashboard

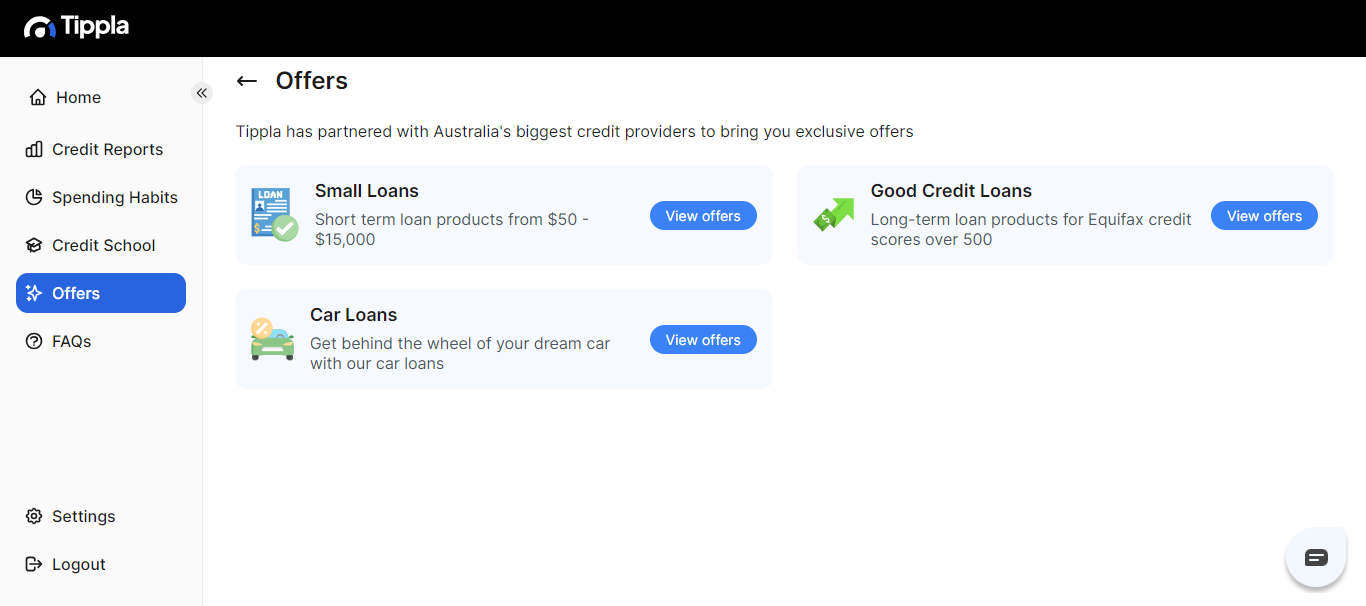

Step 2: Check the Offers tab

Step 3: Choose Your Type of Loan

Small Loans

Tippla provides a list of lenders offering small loans or wage advance loans that range from $1 to $10,000. The loan terms will depend on your eligibility and assessment by the lender, but usually, they fall between 1 to 12 months.

For loans up to $2,000, there’s an establishment fee of 20% of the total loan amount, along with a 4% monthly fee. For loans ranging from $2,001 to $10,000, the interest rate typically falls between 18.92% to 28%, and the comparison rates range from 21.65% to 66.58%.

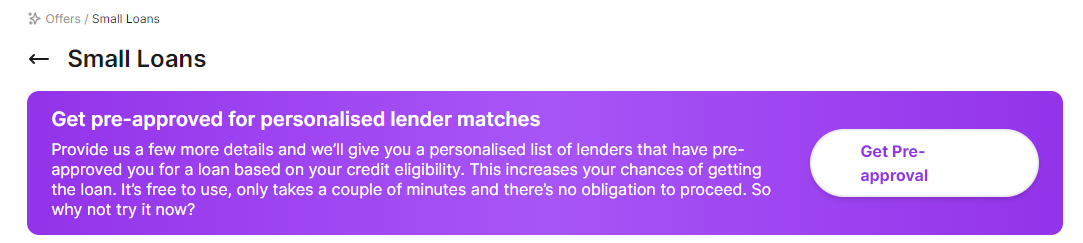

After clicking the ‘Small Loans’ button on your offers dashboard, you’ll be presented with a table that lists various available lenders offering a range of small loan options.

You two courses of actions to choose from:

Option 1: Apply for a small loan from the generic table where different lenders are listed out.

Choosing this option will redirect you to the lender’s website, where you’ll need to complete the application form. Please be aware that selecting this option does not guarantee approval from the lender. It’s important to note that eligibility requirements for the specific lender have not been checked, so approval is not guaranteed.”

Option 2: (Tippla’s recommended option) Use our pre-approval feature

Tippla’s technology uses the information you provide, along with your current credit score and spending habits (if your bank account is linked to Tippla), in order to generate a shortlist of lenders that align with their eligibility criteria. While this process doesn’t guarantee loan funding, it does enhance your approval prospects.

You’ll only need to provide a few details, such as the desired loan amount, loan purpose, and employment status. With this information, we can furnish you with a personalized list of lenders that match your criteria. Subsequently, you can proceed to apply directly with the lender of your choice.

Personal Loans

If you’re looking for Personal Loans, you have the option to borrow up to $50,000 through Tippla’s Good Credit Loans. To apply, simply share your employment information, including your job, monthly income, and how long you’ve been with your current employer. Do note that the final loan amount will depend on a number of eligibility criteria as well as on the lender you will be matched with.

Car Loans

With Tippla, you can quickly get personalised car loan quotes in minutes. Just fill out the form with the assistance of expert brokers. Start by selecting the type of vehicle you want and its model year. You can borrow funds for your car loan through Tippla, ranging up to $200,000 based on your lender’s assessment and your eligibility.

To inquire about personal loans and car loans, just fill out the form. Our expert team will get in touch with you within 15 minutes to discuss potential lender options.

Once you’ve found a suitable loan offer on Tippla, the next step is to submit your online application and wait for the lender’s review. If you receive approval, you’ll discuss and finalise specific loan terms like the amount, interest rate, repayment schedule, term, and any fees.

If you’re comfortable with the terms, you will need to sign the loan agreement. This agreement outlines everything, including your repayment responsibilities and fees. Once signed, the lender will deposit the approved amount directly into your bank account, giving you access to the funds for your needs.

Your responsibility begins as you start making regular repayments as agreed. This covers both the borrowed amount and the interest, and you can choose a repayment frequency that suits you. Keep in mind that while this process generally applies, details may vary based on the lender, loan type, and local rules.

Related articles

How To Provide 100 Points Of ID For An Identity Check

28/07/2021

100 points of ID – Why you need it...

What is a savings account?

28/07/2021

Grow your money faster with savings accounts Unlike everyday...

Rejected for a Loan? Use Your Credit Score To Help

29/07/2021

If you’ve been rejected for a loan or denied...

The Role of Credit Scores in Renting a Property in Australia

05/09/2023

Renting a property in Australia is a significant milestone,...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog