Published in July 28, 2021

Should I lease a car or buy one?

Which is more cost-effective when it comes to buying a car – lease or purchasing with a loan?

When buying a car, you generally have two payment options: Buying the car either outright or with a car loan, or leasing a car. Leasing a car works similarly to long-term rentals, which essentially means you’ll be making monthly payments to drive the car.

Although both options require monthly or weekly payments, they both have their drawbacks and benefits.

Full ownership of a car grants you freedom yet comes with more responsibility. On the contrary, although you won’t have much control over your vehicle with leasing, you’d be eligible to get a trade-in for a new model after a certain amount of years.

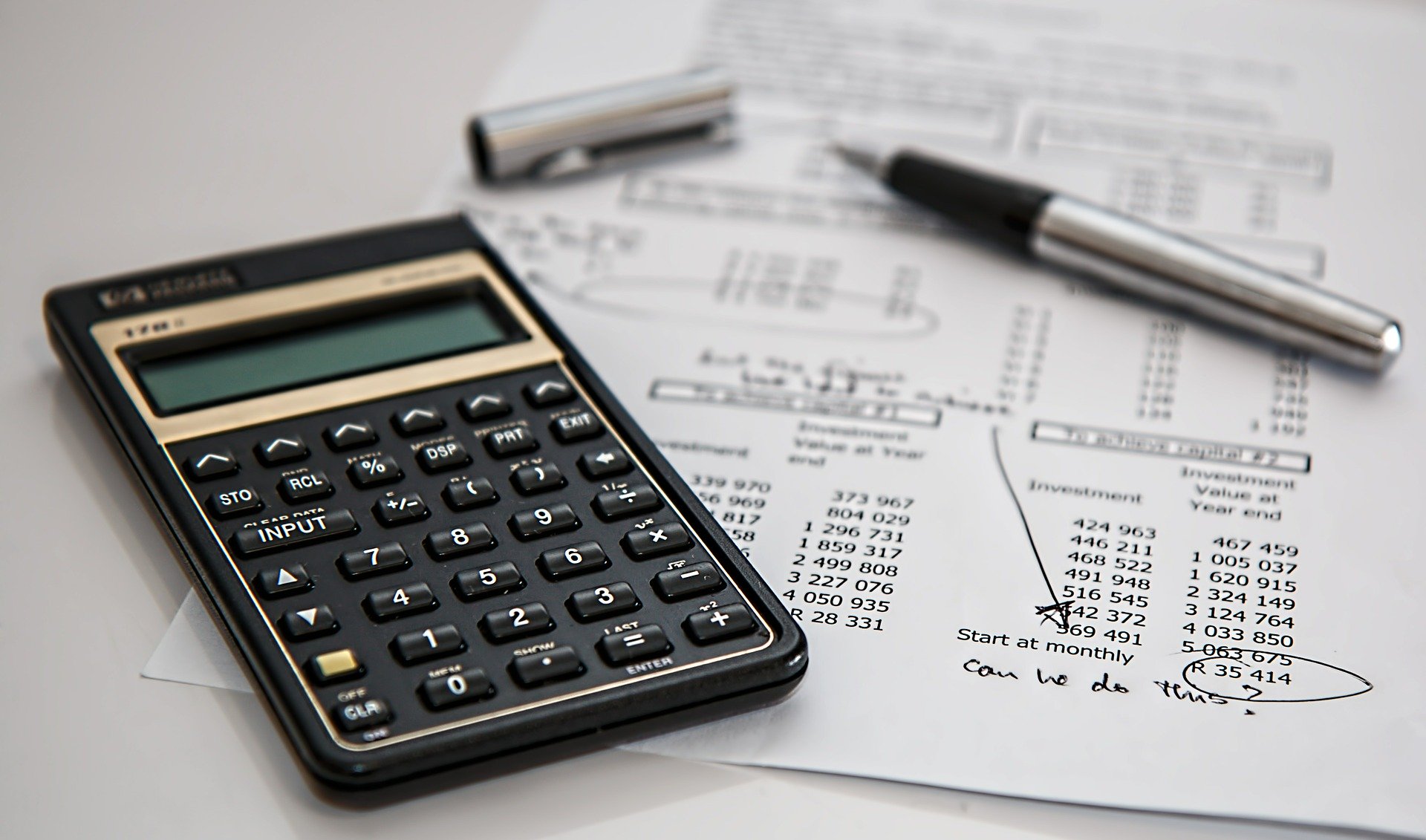

With cost, both options differentiate depending on how much you plan to drive your car for. You’d get lower monthly payments with leasing, however, years of leasing could wind up being more expensive than buying the car.

We’ll break down the pros and cons of both buying and leasing a car.

The pros and cons of buying a car

Buying a car outright works for some people, and is generally the smartest option. However, many people rely on car loans when it comes to financing. Car loans can be taken out by banks, credit unions, or dealerships.

It’s a simple process where the financial institution approves your application, lends you the money, and you would pay it back in increments over a certain period, plus interest.

Pros of buying a car

– Ownership. Buying a car outright essentially grants you full ownership of the car. Similarly with loans, after paying off your debt, the car is yours, which also means you may sell it if you choose to.

– Buying can be cheaper than leasing. Due to depreciation, your car’s value decreases over time, therefore with leasing you’d essentially pay off your car whilst it’s depreciating. On the contrary, with full ownership, you could sell your car while its values are still high.

– You can customise your car. Some drivers may want to add custom upgrades and features to their car, which can only be done if you own the car.

Cons of buying a car

– Higher monthly payments. Although car loan payments have an end date, they tend to be more costly than lease payments.

– Depreciation. Depending on how often you drive your car, they tend to depreciate quickly. Buying a car grants you full ownership of the car after your debt is paid, which means you can’t trade it in for a newer model.

– Maintaining an older car. Buying a car means you’d have to maintain it up until the day you sell it. However, with leasing, you’d be getting a new model every time your lease expires.

The pros and cons of leasing a car

As mentioned before, leasing a car is essentially a long-term rental. A lessor lends you a car in exchange for monthly payment. When your lease term is up, you return the car, with the option of leasing a newer model.

Pros of leasing a car

– Drive a new car every few years. Leasing grants you the opportunity of driving a new car every time your lease term is up.

– Lower monthly payments. If you plan on having a car for a short period, leasing is your best option. That is because you don’t have to pay interest fees with leasing as you would with car loans.

Cons of leasing a car

– Costly in the long term. If you plan on driving the car for a long period, leasing might be costlier than buying it outright or with a car loan. Car loans have an end date on your payments, whilst leasing payments don’t end as long as you’re driving the car.

– Restrictions on your driving. You have to abide by certain restrictions when leasing a car. Restrictions could include a certain annual odometer limit and certain wear and tear.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

Which is better: Personal loans or credit cards?

07/09/2021

Loan 101 – what’s better for me – personal...

How Long Does Bankruptcy Stay On Credit Report?

29/07/2021

There are a number of reasons why someone might...

Do I need car insurance before I buy a car?

09/12/2024

Yes, should have car insurance when you purchase a...

Subscribe to our newsletter

Stay up to date with Tippla's financial blog