Published in September 6, 2023

Credit Scores for International Students in Australia: Building Credit History

In Australia, as in many other countries, a good credit history is a valuable financial asset. It opens doors to various financial opportunities, from obtaining loans and credit cards with favourable terms to securing housing and utility services.

This guide explores the essential aspects of building and managing credit for international students in Australia, providing insights into the advantages of a strong credit profile, the practical steps to initiate your credit journey, and the strategies to maintain and improve your creditworthiness. Understanding the nuances of credit in Australia and adopting responsible credit practices can empower international students to navigate the financial landscape effectively and make the most of their educational experience Down Under.

Understanding Credit Scores and Reports

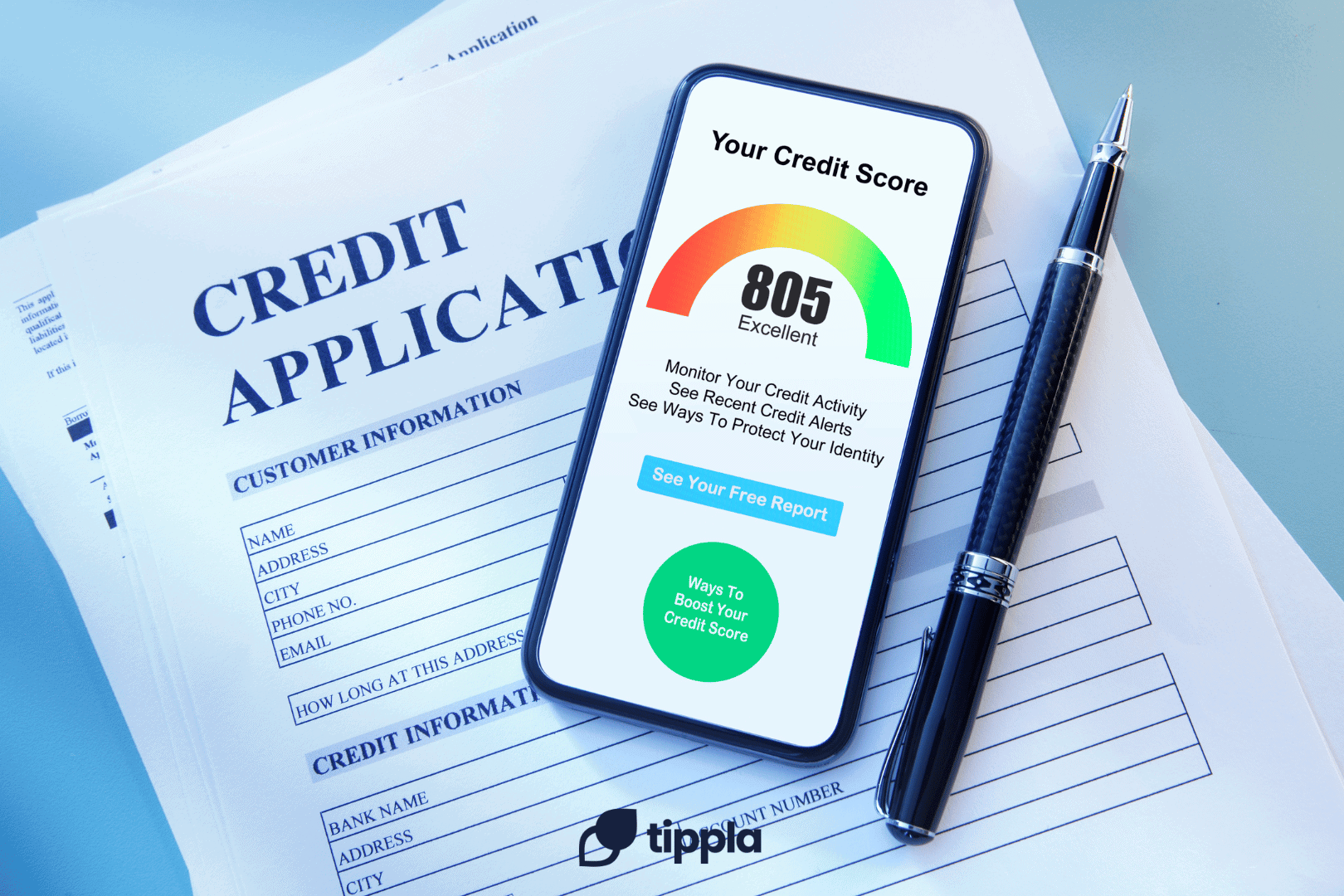

A credit score is a numerical representation of an individual’s creditworthiness. It typically ranges from 0 to 1,200, with higher scores indicating better creditworthiness. Lenders and financial institutions use credit scores to assess the risk associated with lending to an individual. This score is calculated based on your credit history, which includes information about your credit accounts, repayment history, credit enquiries, and public records. It’s a measure of how likely you are to meet your financial obligations.

A higher credit score often leads to better lending terms, such as lower interest rates and higher borrowing limits. It can affect your ability to secure loans, credit cards, and even rental agreements.

On the other hand, a credit report is a detailed document that contains your credit history. It includes information about your open and closed credit accounts, any late payments or defaults, credit enquiries made by lenders, and public records like bankruptcies or court judgments. Credit reports are maintained by credit reporting agencies, and individuals can access their credit reports for free once a year to review their financial history.

When you apply for credit, whether it’s a loan, credit card, or mortgage, lenders will often request your credit report and score to assess your creditworthiness. They use this information to make lending decisions. A positive credit history and a high credit score make you a more attractive borrower, increasing your chances of approval and favourable terms.

Challenges Faced by International Students

International students often face various credit-related challenges when studying abroad. These challenges can be attributed to their unique status and circumstances. Here are some common credit challenges faced by international students:

- Limited Credit History: Many international students have limited or no credit history in the host country, making it challenging to establish credit. Lenders often rely on credit history to assess creditworthiness.

- Financial Constraints: Managing finances in a foreign country can be complex. International students may face financial constraints due to currency exchange rates, tuition fees, and the cost of living. This can affect their ability to meet financial obligations.

- Employment Restrictions: Visa regulations often limit the number of hours international students can work, restricting their income potential. Limited income can make it difficult to access credit.

- Unfamiliarity with Local Financial Systems: Understanding the local financial system, credit scoring mechanisms, and banking practices can be challenging for international students, leading to difficulties in managing credit.

- Language Barrier: Language barriers may hinder effective communication with financial institutions, making it challenging to navigate credit-related processes.

Importance of Building Credit History

Beyond immediate benefits, a strong credit profile is essential for achieving long-term financial goals in Australia. For instance, when international students transition to permanent residents or citizens and aspire to buy a home, a good credit history becomes crucial for obtaining a mortgage with favourable terms. It also supports entrepreneurial endeavours, as a positive credit history facilitates the acquisition of business loans or lines of credit. Moreover, for those interested in investing in financial instruments like stocks and bonds, maintaining good credit can open up investment opportunities, allowing international students to grow their wealth over time.

Starting Your Credit Journey

Some Australian banks like Commonwealth Bank, ANZ, and Westpac offer tailored accounts for international students, often with low or no fees. These accounts can be conveniently set up online or in person and serve as the cornerstone of your financial presence in the country.

Simultaneously, obtaining a Tax File Number (TFN) is crucial for working and managing your finances in Australia. You can apply for a TFN online after arriving in the country, and it’s used for various financial purposes, including tax filings and savings accounts.

Exploring mobile phone plans and utility services is equally vital. Australia boasts a range of mobile phone providers such as Telstra, Optus, and Vodafone, offering prepaid and postpaid plans to cater to your communication needs. Careful comparison ensures you find a plan that suits your budget. Additionally, when renting accommodation, arranging utilities like electricity, gas, and water is essential. Some providers offer student-friendly packages. It’s crucial to notify utility companies when moving to a new place to avoid billing complications.

Building Positive Credit Habits

Building positive credit habits is a fundamental aspect of establishing and sustaining a strong credit history as an international student.

- Pay your bills on time – Timely payments serve as the bedrock of a favourable credit history. Missing payments or making late ones can have adverse effects on your credit score. It’s imperative to ensure that bills, loans, and credit card balances are settled on or before their due dates. Setting up direct debits or reminders through banks and service providers can be a handy tool to avoid inadvertent late payments.

- Manage your credit utilisation responsibly – Credit utilisation, which refers to the proportion of your credit limit that you use, should be kept low. High credit utilisation can negatively impact your credit score. A general rule of thumb is to aim for using no more than 30% of your available credit. Regularly reviewing your credit card and loan statements enables you to monitor your balances effectively, helping you stay within your budget and prevent unexpected high balances.

- Stick to your budget – Developing a monthly budget to track your income and expenses empowers you to manage your finances efficiently. It facilitates timely bill payments and safeguards against overspending.

Exploring Alternative Credit-Building Strategies

- Becoming an authorised user on someone else’s credit card – This method may also allow you to initiate your credit journey. The advantage lies in leveraging their positive credit history. However, it’s imperative to ensure that the primary cardholder possesses a commendable credit history and maintains a record of timely payments.

- Acquiring a secured credit card – Particularly suited for individuals with limited or no credit history, secured credit cards operate by requiring a security deposit that often becomes your credit limit. Responsible use, including punctual payments, can substantially contribute to building your credit profile. During your exploration of secured credit card options, it’s advisable to compare crucial factors such as interest rates, fees, and credit limit requirements. Choose a card that aligns with your needs and offers favourable terms.

- Credit builder loans – Installment loans, such as credit builder loans, also offer another avenue to enhance your credit standing. Some financial institutions provide credit builder loans tailored to assist individuals in establishing credit. Typically, these loans involve smaller amounts and require regular repayments over a predetermined period. Successfully managing such loans, punctually making payments, and practising sound financial management can yield positive impacts on your credit score.

Monitoring and Managing Your Credit

It’s important to regularly check your credit report to ensure the accuracy of your credit history and quickly identify any unauthorised or incorrect entries. By routinely monitoring your credit report, you can detect potential issues early and take proactive steps to address them. In Australia, you can obtain a free copy of your credit report from each credit reporting agency (Experian, Equifax, or Illion) every year, which helps you stay well-informed about your credit history.

💡Helpful Tip! You can start monitoring your credit score for free using Tippla.

Examine your credit report carefully and if you find any discrepancies, report them to the relevant credit reporting agency as they can negatively impact your credit score. Addressing these issues promptly can significantly improve your overall creditworthiness.

Seeking Professional Guidance

Financial advisors and credit experts can provide highly personalised advice when it comes to credit, taking into account your unique financial circumstances. They can help you understand the complicated credit system and recommend actions that align with your goals. Whether you need assistance in debt management, creating effective repayment strategies, or budgeting, their expertise can be invaluable.

Various Australian government bodies and financial institutions like Study Australia and the Department of Education offer online resources explicitly tailored to international students. These materials cover a broad spectrum of financial topics, including insights into credit. Additionally, many Australian universities extend support through financial literacy programs and workshops, equipping students with a deeper understanding of credit and financial management.

Seeking advice that is specifically crafted to suit your financial situation ensures that you receive recommendations that align seamlessly with your aspirations and financial capacities. Furthermore, this personalised guidance helps you steer clear of common financial pitfalls, such as accumulating excessive debt or mishandling credit cards, which could detrimentally affect your credit history.

Conclusion

As an international student in Australia, establishing a positive credit history is a crucial financial milestone. It begins with fundamental steps like opening a bank account and obtaining a Tax File Number (TFN), forming the basis of your financial identity in the country. Paying bills promptly, whether for mobile phone plans or utilities, significantly influences your credit history, especially when these payments are reported to credit bureaus. Responsible management of a student credit card, marked by on-time payments and prudent balance control, can be a wise choice.

Nurturing positive credit habits, such as consistently meeting payment deadlines and maintaining low balances, underpins a robust credit profile. Exploring alternative strategies, like becoming an authorised user on someone else’s credit card or exploring secured credit card options, can also be advantageous. Vigilant credit monitoring, regular review of your credit report for errors, and tracking your credit score over time are essential practices. Seeking guidance from financial advisors and utilising tailored educational resources can provide vital support throughout this credit-building journey. By gradually building your credit, you’ll pave the way for a secure financial future and improved financial prospects in Australia.

While we at Tippla will always do our best to provide you with the information you need to financially thrive, it’s important to note that we’re not debt counsellors, nor do we provide financial advice. Be sure to speak to your financial services professional before making any decisions.

Related articles

Tips and Strategies to Minimise the Negative Effects of Credit Enquiries in Australia

11/10/2023

Managing your credit is crucial for getting loans or...

Tippla Has The Lowdown On Signature Loans!

28/07/2021

What are signature loans? Signature loans are usually given...

What is Credit Repair? How to Fix Your Credit Score

19/10/2021

Mistakes on your credit reports can be quite common....

Subscribe to our newsletter

Stay up to date with Tippla's financial blog